Page 12 - 2022 New Relic Guide

P. 12

Summary of Your Your Health Pre-Tax Spending Life/AD&D Where to Find

Pre-Tax Spending

How to Get Started Dental & Vision 401(k) Additional Benefits

Accounts

Contributions Benefits Accounts Disability Support

PRE-TAX FLEXIBLE SPENDING ACCOUNTS (FSA)

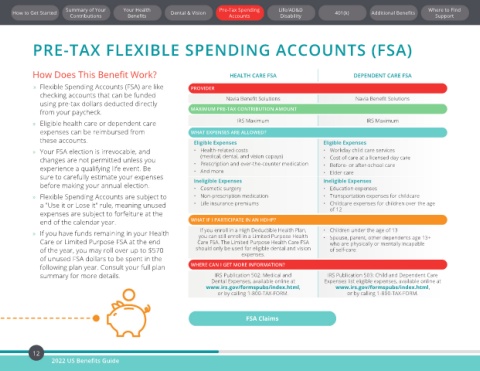

How Does This Benefit Work? HEALTH CARE FSA DEPENDENT CARE FSA

» Flexible Spending Accounts (FSA) are like PROVIDER

checking accounts that can be funded Navia Benefit Solutions Navia Benefit Solutions

using pre-tax dollars deducted directly MAXIMUM PRE-TAX CONTRIBUTION AMOUNT

from your paycheck.

» Eligible health care or dependent care IRS Maximum IRS Maximum

expenses can be reimbursed from WHAT EXPENSES ARE ALLOWED?

these accounts. Eligible Expenses Eligible Expenses

irrevocable,

» Your FSA election is and • Health-related costs • Workday child care services

(medical, dental, and vision copays)

changes are not permitted unless you • Prescription and over-the-counter medication • Cost of care at a licensed day care

• Before- or after-school care

experience a qualifying life event. Be • And more • Elder care

sure to carefully estimate your expenses Ineligible Expenses Ineligible Expenses

before making your annual election. • Cosmetic surgery • Education expenses

» Flexible Spending Accounts are subject to • Non-prescription medication • Transportation expenses for childcare

a "Use it or Lose it" rule, meaning unused • Life insurance premiums • Childcare expenses for children over the age

of 12

forfeiture at

expenses are subject to the

the

end of calendar year. WHAT IF I PARTICIPATE IN AN HDHP?

If you enroll in a High Deductible Health Plan,

• Children under the age of 13

» If you have funds remaining in your Health you can still enroll in a Limited Purpose Health WHO QUALIFIES AS AN ELIGIBLE DEPENDENT?

• Spouse, parent, other dependents age 13+

Care or Limited Purpose FSA at the end Care FSA. The Limited Purpose Health Care FSA who are physically or mentally incapable

of the year, you may roll over up to $570 should only be used for eligible dental and vision of self-care

expenses.

of unused FSA dollars to be spent in the

following plan year. Consult your full plan WHERE CAN I GET MORE INFORMATION?

summary for more details. IRS Publication 502: Medical and IRS Publication 503: Child and Dependent Care

Dental Expenses, available online at Expenses list eligible expenses, available online at

www.irs.gov/formspubs/index.html, www.irs.gov/formspubs/index.html,

or by calling 1-800-TAX-FORM. or by calling 1-800-TAX-FORM.

FSA Claims

12

2022 US Benefits Guide