Page 14 - 2022 New Relic Guide

P. 14

Summary of Your Your Health Pre-Tax Spending Life/AD&D Where to Find

Life/AD&D

How to Get Started Dental & Vision 401(k) Additional Benefits

Contributions Benefits Accounts Disability Support

Disability

LIFE AND AD&D DISABILITY

How do these benefits work? How do these benefits work?

» You are eligible for this coverage if you » You are eligible for this coverage if you are a regular employee

are a regular employee scheduled to scheduled to work at least 20 hours per week.

work at least 20 hours per week. » Disability benefits protect you and your family by providing a portion

» Life insurance is designed to provide of your income during times when you are unable to work.

protection to your family against loss » Duration of disability is determined by treating physician. Maximum

of income due to death benefit period is specified below.

» These benefits are provided at no cost » These benefits are provided at no cost to you.

to you.

» Payments are coordinated with state disability programs when available.

» For life insurance, make sure that your

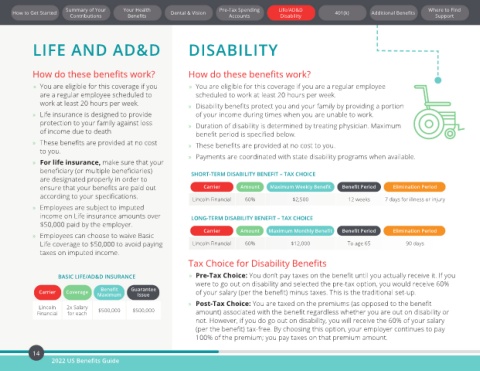

beneficiary (or multiple beneficiaries) SHORT-TERM DISABILITY BENEFIT – TAX CHOICE

are designated properly in order to

ensure that your benefits are paid out Carrier Amount Maximum Weekly Benefit Benefit Period Elimination Period

according to your specifications. Lincoln Financial 60% $2,500 12 weeks 7 days for illness or injury

» Employees are subject to imputed

income on Life insurance amounts over LONG-TERM DISABILITY BENEFIT – TAX CHOICE

$50,000 paid by the employer.

Carrier Amount Maximum Monthly Benefit Benefit Period Elimination Period

» Employees can choose to waive Basic

Life coverage to $50,000 to avoid paying Lincoln Financial 60% $12,000 To age 65 90 days

taxes on imputed income.

Tax Choice for Disability Benefits

BASIC LIFE/AD&D INSURANCE » Pre-Tax Choice: You don’t pay taxes on the benefit until you actually receive it. If you

were to go out on disability and selected the pre-tax option, you would receive 60%

Benefit

Carrier Coverage Maximum Guarantee of your salary (per the benefit) minus taxes. This is the traditional set-up.

Issue

» Post-Tax Choice: You are taxed on the premiums (as opposed to the benefit

Lincoln 2x Salary

Financial for each $500,000 $500,000 amount) associated with the benefit regardless whether you are out on disability or

not. However, if you do go out on disability, you will receive the 60% of your salary

(per the benefit) tax-free. By choosing this option, your employer continues to pay

100% of the premium; you pay taxes on that premium amount.

14

2022 US Benefits Guide