Page 16 - 2022 New Relic Guide

P. 16

Summary of Your Your Health Pre-Tax Spending Life/AD&D Where to Find

401(k)

How to Get Started Dental & Vision 401(k) Additional Benefits

Contributions Benefits Accounts Disability Support

401(k)

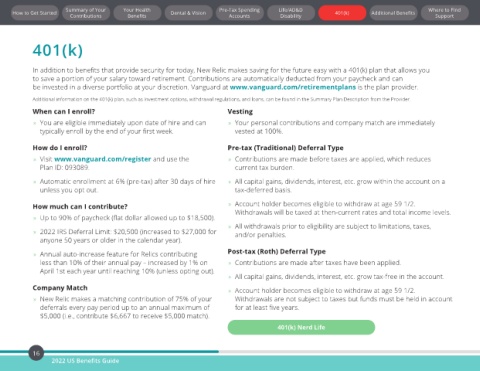

In addition to benefits that provide security for today, New Relic makes saving for the future easy with a 401(k) plan that allows you

to save a portion of your salary toward retirement. Contributions are automatically deducted from your paycheck and can

be invested in a diverse portfolio at your discretion. Vanguard at www.vanguard.com/retirementplans is the plan provider.

Additional information on the 401(k) plan, such as investment options, withdrawal regulations, and loans, can be found in the Summary Plan Description from the Provider.

When can I enroll? Vesting

» You are eligible immediately upon date of hire and can » Your personal contributions and company match are immediately

typically enroll by the end of your first week. vested at 100%.

How do I enroll? Pre-tax (Traditional) Deferral Type

» Visit www.vanguard.com/register and use the » Contributions are made before taxes are applied, which reduces

Plan ID: 093089. current tax burden.

» Automatic enrollment at 6% (pre-tax) after 30 days of hire » All capital gains, dividends, interest, etc. grow within the account on a

unless you opt out. tax-deferred basis.

How much can I contribute? » Account holder becomes eligible to withdraw at age 59 1/2.

Withdrawals will be taxed at then-current rates and total income levels.

» Up to 90% of paycheck (flat dollar allowed up to $18,500).

» All withdrawals prior to eligibility are subject to limitations, taxes,

» 2022 IRS Deferral Limit: $20,500 (increased to $27,000 for and/or penalties.

anyone 50 years or older in the calendar year).

» Annual auto-increase feature for Relics contributing Post-tax (Roth) Deferral Type

less than 10% of their annual pay – increased by 1% on » Contributions are made after taxes have been applied.

April 1st each year until reaching 10% (unless opting out).

» All capital gains, dividends, interest, etc. grow tax-free in the account.

Company Match » Account holder becomes eligible to withdraw at age 59 1/2.

» New Relic makes a matching contribution of 75% of your Withdrawals are not subject to taxes but funds must be held in account

deferrals every pay period up to an annual maximum of for at least five years.

$5,000 (i.e., contribute $6,667 to receive $5,000 match).

401(k) Nerd Life

16

2022 US Benefits Guide