Page 18 - 2022 Clari Open Enrollment Benefits Guide

P. 18

Your Safety Net

y

Life and Disability Insurance

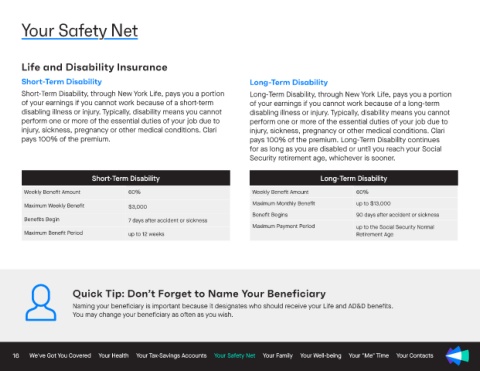

Short-Term Disability Long-Term Disability

Short-Term Disability, through New York Life, pays you a portion Long-Term Disability, through New York Life, pays you a portion

of your earnings if you cannot work because of a short-term of your earnings if you cannot work because of a long-term

disabling illness or injury. Typically, disability means you cannot disabling illness or injury. Typically, disability means you cannot

perform one or more of the essential duties of your job due to perform one or more of the essential duties of your job due to

injury, sickness, pregnancy or other medical conditions. Clari injury, sickness, pregnancy or other medical conditions. Clari

pays 100% of the premium. pays 100% of the premium. Long-Term Disability continues

for as long as you are disabled or until you reach your Social

Security retirement age, whichever is sooner.

Short-Term Disability Long-Term Disability

Weekly Benefit Amount 60% Weekly Benefit Amount 60%

Maximum Weekly Benefit $3,000 Maximum Monthly Benefit up to $13,000

Benefit Begins 90 days after accident or sickness

Benefits Begin 7 days after accident or sickness

Maximum Payment Period up to the Social Security Normal

Maximum Benefit Period up to 12 weeks Retirement Age

Quick Tip: Don’t Forget to Name Your Beneficiary

Naming your beneficiary is important because it designates who should receive your Life and AD&D benefits.

You may change your beneficiary as often as you wish.

16 We've Got You Covered Your Health Your Tax-Savings Accounts Your Safety Net Your Family Your Well-being Your "Me" Time Your Contacts