Page 19 - 2022 Clari Open Enrollment Benefits Guide

P. 19

Your Safety Net

y

Basic Life Insurance Optional Life/AD&D Insurance

Basic Life Insurance, through New York Life, pays If you would like additional life and accident protection, you can purchase

your beneficiary a lump sum if you pass away. AD&D optional life and AD&D insurance. You must purchase supplemental

(Accidental Death & Dismemberment) provides coverage for yourself in order to purchase coverage for your family. Rates

another layer of benefits to either you or your are posted on ADP and are based on your age and coverage amount.

beneficiary if you suffer from loss of a limb, speech,

sight, or hearing or if you have a fatal accident. The • For Yourself - Up to 5x your annual compensation ($500,000 maximum);

cost of coverage is paid in full by the company. $150,000 is available without providing evidence of insurability.

• For Your Spouse/Domestic Partner - 50% of the Employee's amount

($250,000 limit); $25,000 is available without evidence of insurability.

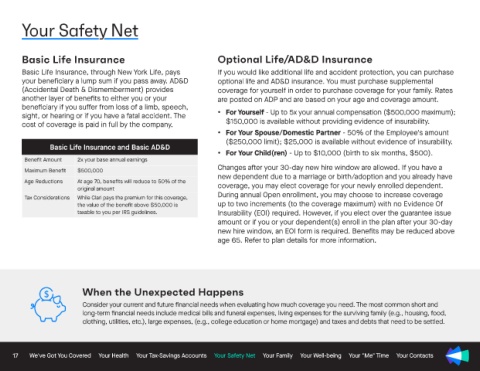

Basic Life Insurance and Basic AD&D

• For Your Child(ren) - Up to $10,000 (birth to six months, $500).

Benefit Amount 2x your base annual earnings

Changes after your 30-day new hire window are allowed. If you have a

Maximum Benefit $500,000

new dependent due to a marriage or birth/adoption and you already have

Age Reductions At age 70, benefits will reduce to 50% of the

original amount coverage, you may elect coverage for your newly enrolled dependent.

Tax Considerations While Clari pays the premium for this coverage, During annual Open enrollment, you may choose to increase coverage

the value of the benefit above $50,000 is up to two increments (to the coverage maximum) with no Evidence Of

taxable to you per IRS guidelines. Insurability (EOI) required. However, if you elect over the guarantee issue

amount or if you or your dependent(s) enroll in the plan after your 30-day

new hire window, an EOI form is required. Benefits may be reduced above

age 65. Refer to plan details for more information.

When the Unexpected Happens

Consider your current and future financial needs when evaluating how much coverage you need. The most common short and

long-term financial needs include medical bills and funeral expenses, living expenses for the surviving family (e.g., housing, food,

clothing, utilities, etc.), large expenses, (e.g., college education or home mortgage) and taxes and debts that need to be settled.

17 We've Got You Covered Your Health Your Tax-Savings Accounts Your Safety Net Your Family Your Well-being Your "Me" Time Your Contacts