Page 16 - 2022 Clari Open Enrollment Benefits Guide

P. 16

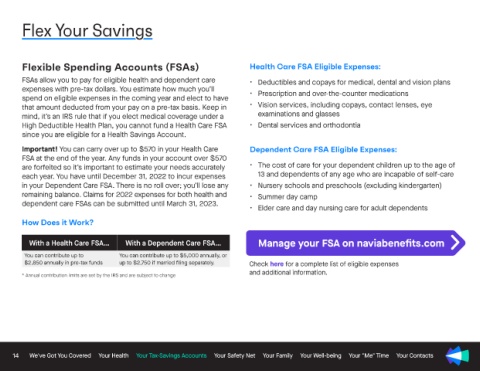

Flex Your Savings

g

Flexible Spending Accounts (FSAs) Health Care FSA Eligible Expenses:

FSAs allow you to pay for eligible health and dependent care • Deductibles and copays for medical, dental and vision plans

expenses with pre-tax dollars. You estimate how much you’ll • Prescription and over-the-counter medications

spend on eligible expenses in the coming year and elect to have

that amount deducted from your pay on a pre-tax basis. Keep in • Vision services, including copays, contact lenses, eye

mind, it’s an IRS rule that if you elect medical coverage under a examinations and glasses

High Deductible Health Plan, you cannot fund a Health Care FSA • Dental services and orthodontia

since you are eligible for a Health Savings Account.

Important! You can carry over up to $570 in your Health Care Dependent Care FSA Eligible Expenses:

FSA at the end of the year. Any funds in your account over $570

are forfeited so it’s important to estimate your needs accurately • The cost of care for your dependent children up to the age of

each year. You have until December 31, 2022 to incur expenses 13 and dependents of any age who are incapable of self-care

in your Dependent Care FSA. There is no roll over; you’ll lose any • Nursery schools and preschools (excluding kindergarten)

remaining balance. Claims for 2022 expenses for both health and • Summer day camp

dependent care FSAs can be submitted until March 31, 2023.

• Elder care and day nursing care for adult dependents

How Does it Work?

With a Health Care FSA… With a Dependent Care FSA… Manage your FSA on naviabenefits.com

You can contribute up to You can contribute up to $5,000 annually, or

$2,850 annually in pre-tax funds up to $2,750 if married filing separately. Check here for a complete list of eligible expenses

and additional information.

* Annual contribution limits are set by the IRS and are subject to change

14 We've Got You Covered Your Health Your Tax-Savings Accounts Your Safety Net Your Family Your Well-being Your "Me" Time Your Contacts