Page 15 - 2022 Clari Open Enrollment Benefits Guide

P. 15

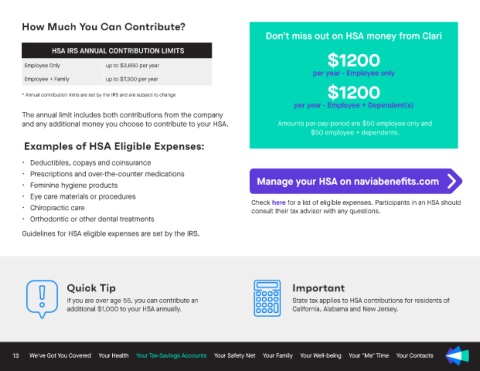

How Much You Can Contribute?

Don’t miss out on HSA money from Clari

HSA IRS ANNUAL CONTRIBUTION LIMITS $1200

Employee Only up to $3,650 per year

per year - Employee only

Employee + Family up to $7,300 per year $1200

* Annual contribution limits are set by the IRS and are subject to change

per year - Employee + Dependent(s)

The annual limit includes both contributions from the company

and any additional money you choose to contribute to your HSA. Amounts per-pay-period are $50 employee only and

$50 employee + dependents.

Examples of HSA Eligible Expenses:

• Deductibles, copays and coinsurance

• Prescriptions and over-the-counter medications

• Feminine hygiene products Manage your HSA on naviabenefits.com

• Eye care materials or procedures

Check here for a list of eligible expenses. Participants in an HSA should

• Chiropractic care consult their tax advisor with any questions.

• Orthodontic or other dental treatments

Guidelines for HSA eligible expenses are set by the IRS.

Quick Tip Important

If you are over age 55, you can contribute an State tax applies to HSA contributions for residents of

additional $1,000 to your HSA annually. California, Alabama and New Jersey.

13 We've Got You Covered Your Health Your Tax-Savings Accounts Your Safety Net Your Family Your Well-being Your "Me" Time Your Contacts