Page 9 - 2022 Clari Open Enrollment Benefits Guide

P. 9

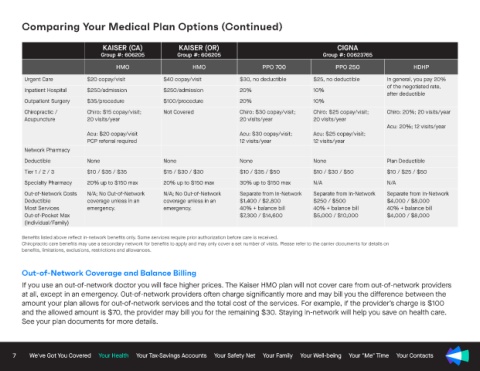

Comparing Your Medical Plan Options (Continued)

KAISER (CA) KAISER (OR) CIGNA

Group #: 606205 Group #: 606205 Group #: 00623765

HMO HMO PPO 700 PPO 250 HDHP

Urgent Care $20 copay/visit $40 copay/visit $30, no deductible $25, no deductible In general, you pay 20%

of the negotiated rate,

Inpatient Hospital $250/admission $250/admission 20% 10%

after deductible

Outpatient Surgery $35/procedure $100/procedure 20% 10%

Chiropractic / Chiro: $15 copay/visit; Not Covered Chiro: $30 copay/visit; Chiro: $25 copay/visit; Chiro: 20%; 20 visits/year

Acupuncture 20 visits/year 20 visits/year 20 visits/year

Acu: 20%; 12 visits/year

Acu: $20 copay/visit Acu: $30 copay/visit; Acu: $25 copay/visit;

PCP referral required 12 visits/year 12 visits/year

Network Pharmacy

Deductible None None None None Plan Deductible

Tier 1 / 2 / 3 $10 / $35 / $35 $15 / $30 / $30 $10 / $35 / $50 $10 / $30 / $50 $10 / $25 / $50

Specialty Pharmacy 20% up to $150 max 20% up to $150 max 30% up to $150 max N/A N/A

Out-of-Network Costs N/A; No Out-of-Network N/A; No Out-of-Network Separate from In-Network Separate from In-Network Separate from In-Network

Deductible coverage unless in an coverage unless in an $1,400 / $2,800 $250 / $500 $4,000 / $8,000

Most Services emergency. emergency. 40% + balance bill 40% + balance bill 40% + balance bill

Out-of-Pocket Max $7,300 / $14,600 $5,000 / $10,000 $4,000 / $8,000

(Individual/Family)

Benefits listed above reflect in-network benefits only. Some services require prior authorization before care is received.

Chiropractic care benefits may use a secondary network for benefits to apply and may only cover a set number of visits. Please refer to the carrier documents for details on

benefits, limitations, exclusions, restrictions and allowances.

Out-of-Network Coverage and Balance Billing

If you use an out-of-network doctor you will face higher prices. The Kaiser HMO plan will not cover care from out-of-network providers

at all, except in an emergency. Out-of-network providers often charge significantly more and may bill you the difference between the

amount your plan allows for out-of-network services and the total cost of the services. For example, if the provider’s charge is $100

and the allowed amount is $70, the provider may bill you for the remaining $30. Staying in-network will help you save on health care.

See your plan documents for more details.

7 We've Got You Covered Your Health Your Tax-Savings Accounts Your Safety Net Your Family Your Well-being Your "Me" Time Your Contacts