Page 5 - 2022 01 Benefits Guide Murata Flipbook Final 6.14.22

P. 5

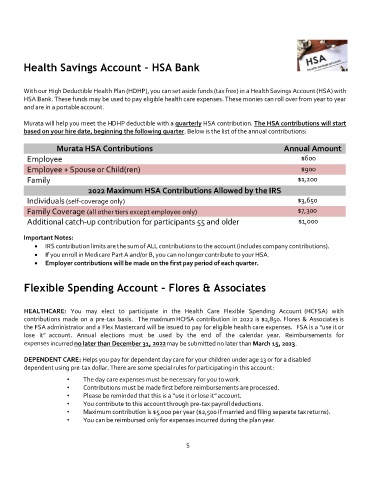

Health Savings Account – HSA Bank

With our High Deductible Health Plan (HDHP), you can set aside funds (tax free) in a Health Savings Account (HSA) with

HSA Bank. These funds may be used to pay eligible health care expenses. These monies can roll over from year to year

and are in a portableaccount.

Murata will help you meet the HDHP deductible with a quarterly HSA contribution. The HSA contributions will start

based on your hire date, beginning the following quarter. Below is the list of the annual contributions:

Murata HSA Contributions Annual Amount

Employee $600

Employee + Spouse or Child(ren) $900

Family $1,200

2022 Maximum HSA Contributions Allowed by the IRS

Individuals (self-coverage only) $3,650

Family Coverage (all other tiers except employee only) $7,300

Additional catch-up contribution for participants 55 and older $1,000

Important Notes:

• IRS contribution limits are the sumof ALL contributions to the account (includescompany contributions).

• If you enroll in Medicare Part A and/or B, you can no longer contribute to your HSA.

• Employer contributions will be made on the first pay period of each quarter.

Flexible Spending Account – Flores & Associates

HEALTHCARE: You may elect to participate in the Health Care Flexible Spending Account (HCFSA) with

contributions made on a pre-tax basis. The maximumHCFSA contribution in 2022 is $2,850. Flores & Associates is

the FSA administrator and a Flex Mastercard will be issued to pay for eligible health care expenses. FSA is a “use it or

lose it” account. Annual elections must be used by the end of the calendar year. Reimbursements for

expenses incurred no later than December 31, 2022may be submitted no later than March 15, 2023.

DEPENDENT CARE: Helps you pay for dependent day care for your children under age 13 or for a disabled

dependent using pre-tax dollar. There are some special rules for participating in this account:

• The day care expenses must be necessary for you towork.

• Contributions must be made first before reimbursements are processed.

• Please be reminded that this is a “use it or lose it”account.

• You contribute to this account through pre-tax payroll deductions.

• Maximum contribution is $5,000 per year ($2,500 if married and filing separate taxreturns).

• You can be reimbursed only for expenses incurred during the plan year.

5