Page 31 - HR_10930_2022_Benefits_Book_v6_pages - With Links for Flipbook

P. 31

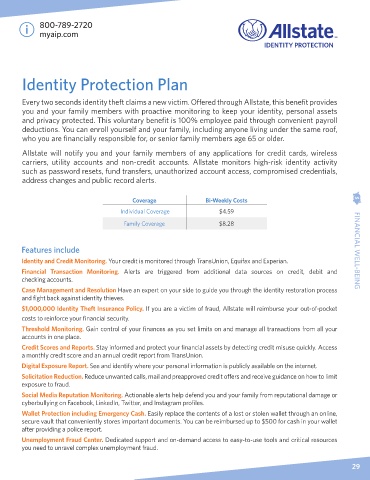

i 800-789-2720

myaip.com

Identity Protection Plan

Every two seconds identity theft claims a new victim. Offered through Allstate, this benefit provides

you and your family members with proactive monitoring to keep your identity, personal assets

and privacy protected. This voluntary benefit is 100% employee paid through convenient payroll

deductions. You can enroll yourself and your family, including anyone living under the same roof,

who you are financially responsible for, or senior family members age 65 or older.

Allstate will notify you and your family members of any applications for credit cards, wireless

carriers, utility accounts and non-credit accounts. Allstate monitors high-risk identity activity

such as password resets, fund transfers, unauthorized account access, compromised credentials,

address changes and public record alerts.

Coverage Bi-Weekly Costs

Individual Coverage $4.59

Family Coverage $8.28

Features include FINANCIAL WELL-BEING

Identity and Credit Monitoring. Your credit is monitored through TransUnion, Equifax and Experian.

Financial Transaction Monitoring. Alerts are triggered from additional data sources on credit, debit and

checking accounts.

Case Management and Resolution Have an expert on your side to guide you through the identity restoration process

and fight back against identity thieves.

$1,000,000 Identity Theft Insurance Policy. If you are a victim of fraud, Allstate will reimburse your out-of-pocket

costs to reinforce your financial security.

Threshold Monitoring. Gain control of your finances as you set limits on and manage all transactions from all your

accounts in one place.

Credit Scores and Reports. Stay informed and protect your financial assets by detecting credit misuse quickly. Access

a monthly credit score and an annual credit report from TransUnion.

Digital Exposure Report. See and identify where your personal information is publicly available on the internet.

Solicitation Reduction. Reduce unwanted calls, mail and preapproved credit offers and receive guidance on how to limit

exposure to fraud.

Social Media Reputation Monitoring. Actionable alerts help defend you and your family from reputational damage or

cyberbullying on Facebook, LinkedIn, Twitter, and Instagram profiles.

Wallet Protection including Emergency Cash. Easily replace the contents of a lost or stolen wallet through an online,

secure vault that conveniently stores important documents. You can be reimbursed up to $500 for cash in your wallet

after providing a police report.

Unemployment Fraud Center. Dedicated support and on-demand access to easy-to-use tools and critical resources

you need to unravel complex unemployment fraud.

28 29