Page 16 - OpenX 2022 Book of Benefits

P. 16

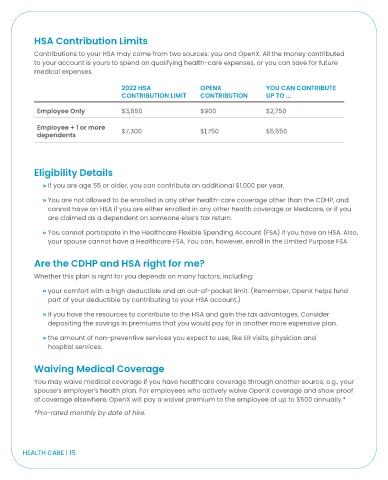

HSA Contribution Limits

Contributions to your HSA may come from two sources: you and OpenX. All the money contributed

to your account is yours to spend on qualifying health-care expenses, or you can save for future

medical expenses.

2022 HSA OPENX YOU CAN CONTRIBUTE

CONTRIBUTION LIMIT CONTRIBUTION UP TO ...

Employee Only $3,650 $900 $2,750

Employee + 1 or more

$7,300 $1,750 $5,550

dependents

Eligibility Details

» If you are age 55 or older, you can contribute an additional $1,000 per year.

» You are not allowed to be enrolled in any other health-care coverage other than the CDHP, and

cannot have an HSA if you are either enrolled in any other health coverage or Medicare, or if you

are claimed as a dependent on someone else’s tax return.

» You cannot participate in the Healthcare Flexible Spending Account (FSA) if you have an HSA. Also,

your spouse cannot have a Healthcare FSA. You can, however, enroll in the Limited Purpose FSA.

Are the CDHP and HSA right for me?

Whether this plan is right for you depends on many factors, including:

» your comfort with a high deductible and an out-of-pocket limit. (Remember, OpenX helps fund

part of your deductible by contributing to your HSA account.)

» if you have the resources to contribute to the HSA and gain the tax advantages. Consider

depositing the savings in premiums that you would pay for in another more expensive plan.

» the amount of non-preventive services you expect to use, like ER visits, physician and

hospital services.

Waiving Medical Coverage

You may waive medical coverage if you have healthcare coverage through another source, e.g., your

spouse’s employer’s health plan. For employees who actively waive OpenX coverage and show proof

of coverage elsewhere, OpenX will pay a waiver premium to the employee of up to $500 annually.*

*Pro-rated monthly by date of hire.

HEALTH CARE | 15