Page 19 - Tessenderlo Kerley, Inc 2022 Benefit Guide

P. 19

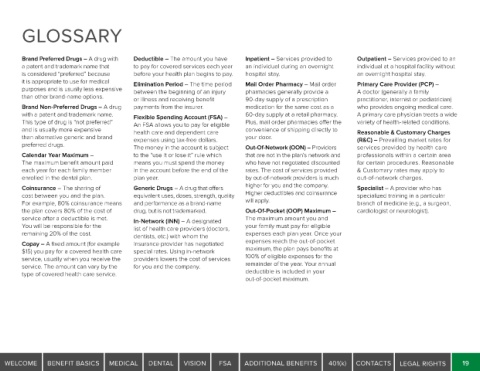

GLOSSARY

Brand Preferred Drugs – A drug with Deductible – The amount you have Inpatient – Services provided to Outpatient – Services provided to an

a patent and trademark name that to pay for covered services each year an individual during an overnight individual at a hospital facility without

is considered “preferred” because before your health plan begins to pay. hospital stay. an overnight hospital stay.

it is appropriate to use for medical Elimination Period – The time period Mail Order Pharmacy – Mail order Primary Care Provider (PCP) –

purposes and is usually less expensive between the beginning of an injury pharmacies generally provide a A doctor (generally a family

than other brand-name options. or illness and receiving benefit 90-day supply of a prescription practitioner, internist or pediatrician)

Brand Non-Preferred Drugs – A drug payments from the insurer. medication for the same cost as a who provides ongoing medical care.

with a patent and trademark name. Flexible Spending Account (FSA) – 60-day supply at a retail pharmacy. A primary care physician treats a wide

This type of drug is “not preferred” An FSA allows you to pay for eligible Plus, mail order pharmacies offer the variety of health-related conditions.

and is usually more expensive health care and dependent care convenience of shipping directly to Reasonable & Customary Charges

than alternative generic and brand expenses using tax-free dollars. your door. (R&C) – Prevailing market rates for

preferred drugs. The money in the account is subject Out-Of-Network (OON) – Providers services provided by health care

Calendar Year Maximum – to the “use it or lose it” rule which that are not in the plan’s network and professionals within a certain area

The maximum benefit amount paid means you must spend the money who have not negotiated discounted for certain procedures. Reasonable

each year for each family member in the account before the end of the rates. The cost of services provided & Customary rates may apply to

enrolled in the dental plan. plan year. by out-of-network providers is much out-of-network charges.

Coinsurance – The sharing of Generic Drugs – A drug that offers higher for you and the company. Specialist – A provider who has

cost between you and the plan. equivalent uses, doses, strength, quality Higher deductibles and coinsurance specialized training in a particular

For example, 80% coinsurance means and performance as a brand-name will apply. branch of medicine (e.g., a surgeon,

the plan covers 80% of the cost of drug, but is not trademarked. Out-Of-Pocket (OOP) Maximum – cardiologist or neurologist).

service after a deductible is met. In-Network (INN) – A designated The maximum amount you and

You will be responsible for the list of health care providers (doctors, your family must pay for eligible

remaining 20% of the cost. dentists, etc.) with whom the expenses each plan year. Once your

Copay – A fixed amount (for example insurance provider has negotiated expenses reach the out-of-pocket

$15) you pay for a covered health care special rates. Using in-network maximum, the plan pays benefits at

service, usually when you receive the providers lowers the cost of services 100% of eligible expenses for the

service. The amount can vary by the for you and the company. remainder of the year. Your annual

type of covered health care service. deductible is included in your

out-of-pocket maximum.

WELCOME BENEFIT BASICS MEDICAL DENTAL VISION FSA ADDITIONAL BENEFITS 401(k) CONTACTS LEGAL RIGHTS 19