Page 22 - TriStar Energy-2023-Benefit Guide-V26(WLP)-LRI

P. 22

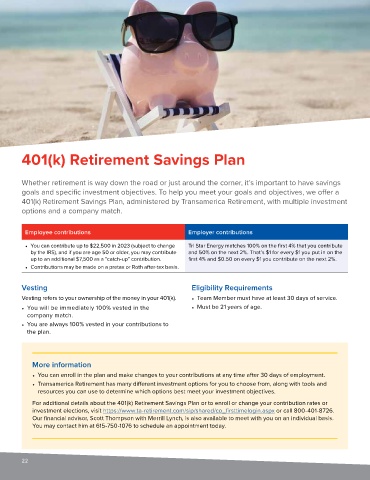

401(k) Retirement Savings Plan

Whether retirement is way down the road or just around the corner, it’s important to have savings

goals and specific investment objectives. To help you meet your goals and objectives, we offer a

401(k) Retirement Savings Plan, administered by Transamerica Retirement, with multiple investment

options and a company match.

Employee contributions Employer contributions

• You can contribute up to $22,500 in 2023 (subject to change Tri Star Energy matches 100% on the first 4% that you contribute

by the IRS), and if you are age 50 or older, you may contribute and 50% on the next 2%. That’s $1 for every $1 you put in on the

up to an additional $7,500 as a “catch-up” contribution. first 4% and $0.50 on every $1 you contribute on the next 2%.

• Contributions may be made on a pretax or Roth after-tax basis.

Vesting Eligibility Requirements

Vesting refers to your ownership of the money in your 401(k). • Team Member must have at least 30 days of service.

• You will be immediately 100% vested in the • Must be 21 years of age.

company match.

• You are always 100% vested in your contributions to

the plan.

More information

• You can enroll in the plan and make changes to your contributions at any time after 30 days of employment.

• Transamerica Retirement has many different investment options for you to choose from, along with tools and

resources you can use to determine which options best meet your investment objectives.

For additional details about the 401(k) Retirement Savings Plan or to enroll or change your contribution rates or

investment elections, visit https://www.ta-retirement.com/sip/shared/co_firsttimelogin.aspx or call 800-401-8726.

Our financial advisor, Scott Thompson with Merrill Lynch, is also available to meet with you on an individual basis.

You may contact him at 615-750-1076 to schedule an appointment today.

22