Page 18 - TriStar Energy-2023-Benefit Guide-V26(WLP)-LRI

P. 18

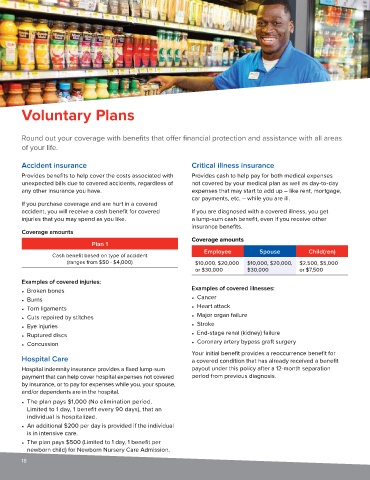

Voluntary Plans

Round out your coverage with benefits that offer financial protection and assistance with all areas

of your life.

Accident insurance Critical illness insurance

Provides benefits to help cover the costs associated with Provides cash to help pay for both medical expenses

unexpected bills due to covered accidents, regardless of not covered by your medical plan as well as day-to-day

any other insurance you have. expenses that may start to add up – like rent, mortgage,

car payments, etc. – while you are ill.

If you purchase coverage and are hurt in a covered

accident, you will receive a cash benefit for covered If you are diagnosed with a covered illness, you get

injuries that you may spend as you like. a lump-sum cash benefit, even if you receive other

insurance benefits.

Coverage amounts

Coverage amounts

Plan 1

Employee Spouse Child(ren)

Cash benefit based on type of accident

(ranges from $50 - $4,000) $10,000, $20,000 $10,000, $20,000, $2,500, $5,000

or $30,000 $30,000 or $7,500

Examples of covered injuries:

• Broken bones Examples of covered illnesses:

• Burns • Cancer

• Torn ligaments • Heart attack

• Cuts repaired by stitches • Major organ failure

• Eye injuries • Stroke

• Ruptured discs • End-stage renal (kidney) failure

• Concussion • Coronary artery bypass graft surgery

Your initial benefit provides a reoccurrence benefit for

Hospital Care a covered condition that has already received a benefit

Hospital indemnity insurance provides a fixed lump-sum payout under this policy after a 12-month separation

payment that can help cover hospital expenses not covered period from previous diagnosis.

by insurance, or to pay for expenses while you, your spouse,

and/or dependents are in the hospital.

• The plan pays $1,000 (No elimination period.

Limited to 1 day, 1 benefit every 90 days), that an

individual is hospitalized.

• An additional $200 per day is provided if the individual

is in intensive care.

• The plan pays $500 (Limited to 1 day, 1 benefit per

newborn child) for Newborn Nursery Care Admission.

18