Page 6 - Goodwill Columbus 2022 Benefit Guide

P. 6

A Guide to Your Benefits | 2022

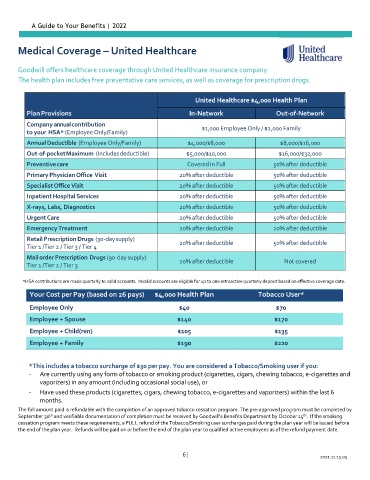

Medical Coverage – United Healthcare

Goodwill offers healthcare coverage through United Healthcare insurance company.

The health plan includes free preventative care services, as well as coverage for prescription drugs.

United Healthcare $4,000 Health Plan

Plan Provisions In-Network Out-of-Network

Company annual contribution $1,000 Employee Only / $2,000 Family

to your HSA* (Employee Only/Family)

Annual Deductible (Employee Only/Family) $4,000/$8,000 $8,000/$16,000

Out-of-pocket Maximum (Includes deductible) $5,000/$10,000 $16,000/$32,000

Preventive care Covered in Full 50% after deductible

Primary Physician Office Visit 20% after deductible 50% after deductible

Specialist Office Visit 20% after deductible 50% after deductible

Inpatient Hospital Services 20% after deductible 50% after deductible

X-rays, Labs, Diagnostics 20% after deductible 50% after deductible

Urgent Care 20% after deductible 50% after deductible

Emergency Treatment 20% after deductible 20% after deductible

Retail Prescription Drugs (30-day supply) 20% after deductible 50% after deductible

Tier 1 /Tier 2 / Tier 3 / Tier 4

Mail order Prescription Drugs (90-day supply)

Tier 1 /Tier 2 / Tier 3 20% after deductible Not covered

*HSA contributions are made quarterly to valid accounts. Invalid accounts are eligible for up to one retroactive quarterly deposit based on effective coverage date.

Your Cost per Pay (based on 26 pays) $4,000 Health Plan Tobacco User*

Employee Only $40 $70

Employee + Spouse $140 $170

Employee + Child(ren) $105 $135

Employee + Family $190 $220

*This includes a tobacco surcharge of $30 per pay. You are considered a Tobacco/Smoking user if you:

- Are currently using any form of tobacco or smoking product (cigarettes, cigars, chewing tobacco, e-cigarettes and

vaporizers) in any amount (including occasional social use), or

- Have used these products (cigarettes, cigars, chewing tobacco, e-cigarettes and vaporizers) within the last 6

months.

The full amount paid is refundable with the completion of an approved tobacco cessation program. The pre-approved program must be completed by

September 30 and verifiable documentation of completion must be received by Goodwill's Benefits Department by October 15 . If the smoking

th

th

cessation program meets these requirements, a FULL refund of the Tobacco/Smoking user surcharges paid during the plan year will be issued before

the end of the plan year. Refunds will be paid on or before the end of the plan year to qualified active employees as of the refund payment date.

6 | 2021.11.15.05