Page 234 - FBL AR 2019-20

P. 234

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Consolidated financial statements for the year ended March 31, 2020

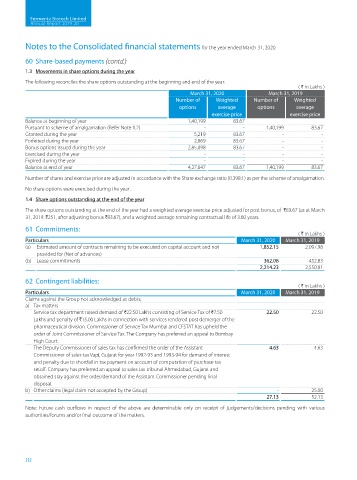

60 Share-based payments (contd.)

1.3 Movements in share options during the year

The following reconciles the share options outstanding at the beginning and end of the year:

( H in Lakhs )

March 31, 2020 March 31, 2019

Number of Weighted Number of Weighted

options average options average

exercise price exercise price

Balance at beginning of year 1,40,199 83.67 - -

Pursuant to scheme of amalgamation (Refer Note 1.2) - - 1,40,199 83.67

Granted during the year 5,219 83.67 - -

Forfeited during the year 2,869 83.67 - -

Bonus options issued during the year 2,85,098 83.67 - -

Exercised during the year - - - -

Expired during the year - - - -

Balance at end of year 4,27,647 83.67 1,40,199 83.67

Number of shares and exercise price are adjusted in accordance with the Share exchange ratio (0.398:1) as per the scheme of amalgamation.

No share options were exercised during the year .

1.4 Share options outstanding at the end of the year

The share options outstanding at the end of the year had a weighted average exercise price adjusted for post bonus, of H83.67 (as at March

31, 2019: H251, after adjusting bonus H83.67), and a weighted average remaining contractual life of 3.80 years.

61 Commitments:

( H in Lakhs )

Particulars March 31, 2020 March 31, 2019

(a) Estimated amount of contracts remaining to be executed on capital account and not 1,852.15 2,097.98

provided for (Net of advances)

(b) Lease commitments 362.08 452.83

2,214.23 2,550.81

62 Contingent liabilities:

( H in Lakhs )

Particulars March 31, 2020 March 31, 2019

Claims against the Group not acknowledged as debts;

a) Tax matters

Service tax department raised demand of H22.50 Lakhs consisting of Service Tax of H7.50 22.50 22.50

Lakhs and penalty of H15.00 Lakhs in connection with services rendered post demerger of the

pharmaceutical division. Commissioner of Service Tax Mumbai and CESTAT has upheld the

order of Joint Commissioner of Service Tax. The Company has preferred an appeal to Bombay

High Court.

The Deputy Commissioner of sales tax has confirmed the order of the Assistant 4.63 4.63

Commissioner of sales tax Vapi, Gujarat for year 1992-93 and 1993-94 for demand of interest

and penalty due to shortfall in tax payment on account of computation of purchase tax

setoff. Company has preferred an appeal to sales tax tribunal Ahmedabad, Gujarat and

obtained stay against the order/demand of the Assistant Commissioner pending final

disposal.

b) Other claims (legal claim not accepted by the Group) - 25.00

27.13 52.13

Note: Future cash outflows in respect of the above are determinable only on receipt of judgements/decisions pending with various

authorities/forums and/or final outcome of the matters.

232