Page 229 - FBL AR 2019-20

P. 229

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

Notes to the Consolidated financial statements for the year ended March 31, 2020

56 Financial risk management objectives and policies (contd.)

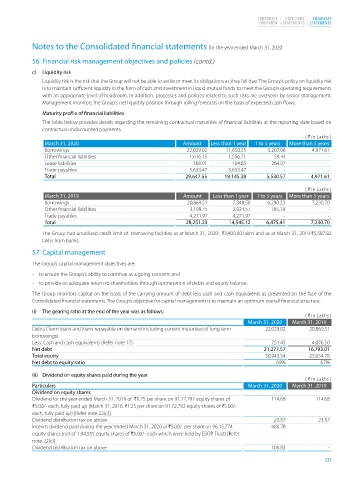

c) Liquidity risk

Liquidity risk is the risk that the Group will not be able to settle or meet its obligations as they fall due. The Group’s policy on liquidity risk

is to maintain sufficient liquidity in the form of cash and investment in liquid mutual funds to meet the Group’s operating requirements

with an appropriate level of headroom. In addition, processes and policies related to such risks are overseen by senior management.

Management monitors the Group’s net liquidity position through rolling forecasts on the basis of expected cash flows.

Maturity profile of financial liabilities

The table below provides details regarding the remaining contractual maturities of financial liabilities at the reporting date based on

contractual undiscounted payments.

( H in Lakhs )

March 31, 2020 Amount Less than 1 year 1 to 5 years More than 5 years

Borrowings 22,029.02 11,850.35 5,207.06 4,971.61

Other financial liabilities 1,616.15 1,556.71 59.44 -

Lease liabilities 368.91 104.85 264.07 -

Trade payables 5,633.47 5,633.47 - -

Total 29,647.55 19,145.38 5,530.57 4,971.61

( H in Lakhs )

March 31, 2019 Amount Less than 1 year 1 to 5 years More than 5 years

Borrowings 20,869.51 7,348.58 6,290.23 7,230.70

Other financial liabilities 3,109.75 2,924.57 185.18 -

Trade payables 4,271.97 4,271.97 - -

Total 28,251.23 14,545.12 6,475.41 7,230.70

The Group had unutilised credit limit of borrowing facilities as at March 31, 2020: H3,400.00 lakhs and as at March 31, 2019 H5,587.82

lakhs from banks.

57 Capital management

The Group’s capital management objectives are:

- to ensure the Groups’s ability to continue as a going concern; and

- to provide an adequate return to shareholders through optimisation of debts and equity balance.

The Group monitors capital on the basis of the carrying amount of debt less cash and cash equivalents as presented on the face of the

Consolidated financial statements. The Group’s objective for capital management is to maintain an optimum overall financial structure.

(i) The gearing ratio at the end of the year was as follows:

( H in Lakhs )

March 31, 2020 March 31, 2019

Debts (Term loans and loans repayable on demand including current maturities of long term 22,029.02 20,869.51

borrowings)

Less: Cash and cash equivalents (Refer note 17) 751.45 4,076.50

Net debt 21,277.57 16,793.01

Total equity 30,943.54 25,054.78

Net debt to equity ratio 69% 67%

(ii) Dividend on equity shares paid during the year

( H in Lakhs )

Particulars March 31, 2020 March 31, 2019

Dividend on equity shares

Dividend for the year ended March 31, 2019 of H1.25 per share on 91,72,792 equity shares of 114.68 114.68

H5.00/- each, fully paid up (March 31, 2018: H1.25 per share on 91,72,792 equity shares of H5.00/-

each, fully paid up) [Refer note 22(c)]

Dividend distribution tax on above 23.57 23.57

Interim dividend paid during the year ended March 31, 2020 of H5.00/- per share on 96,15,774 480.78 -

equity shares (net of 1,94,555 equity shares of H5.00/- each which were held by ESOP Trust) [Refer

note 22(c)]

Dividend distribution tax on above 100.83 -

227