Page 231 - FBL AR 2019-20

P. 231

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

Notes to the Consolidated financial statements for the year ended March 31, 2020

58 Investment properties (contd.)

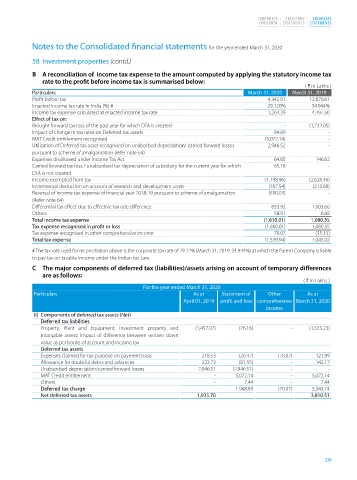

B A reconciliation of income tax expense to the amount computed by applying the statutory income tax

rate to the profit before income tax is summarised below:

( H in Lakhs )

Particulars March 31, 2020 March 31, 2019

Profit before tax 4,342.01 12,870.61

Enacted income tax rate in India (%) # 29.120% 34.944%

Income tax expense calculated at enacted income tax rate 1,264.39 4,497.50

Effect of tax on:

Brought forward tax loss of the past year for which DTA is created - (1,732.05)

Impact of change in tax rates on Deferred tax assets 84.89 -

MAT Credit entitlement recognised (5,072.14) -

Utilisation of Deferred tax asset recognised on unaborbed depreciation/ carried forward losses 2,946.52 -

pursuant to scheme of amalgamation (refer note 64)

Expenses disallowed under Income Tax Act 64.85 146.62

Carried forward tax loss / unabsorbed tax depreciation of subsidairy for the current year for which 65.18 -

DTA is not created

Income exempted from tax (1,198.96) (2,628.46)

Incremental deduction on account of research and development costs (167.54) (213.60)

Reversal of income tax expense of financial year 2018-19 pursuant to scheme of amalgamation (510.03) -

(Refer note 64)

Differential tax effect due to effective tax rate difference 853.92 1,003.66

Others 58.91 6.68

Total income tax expense (1,610.01) 1,080.35

Tax expense recognised in profit or loss (1,610.01) 1,080.35

Tax expense recognised in other comprehensive income 70.07 (35.33)

Total tax expense (1,539.94) 1,045.02

# The tax rate used for reconciliation above is the corporate tax rate of 29.12% (March 31, 2019: 34.944%) at which the Parent Company is liable

to pay tax on taxable income under the Indian tax Law.

C The major components of deferred tax (liabilities)/assets arising on account of temporary differences

are as follows:

( H in Lakhs )

For the year ended March 31, 2020

Particulars As at Statement of Other As at

April 01, 2019 profit and loss comprehensive March 31, 2020

income

(I) Components of deferred tax assets (Net)

Deferred tax liabilities

Property, Plant and Equipment, investment property and (1,457.07) (76.16) - (1,533.23)

intangible assets: Impact of difference between written down

value as per books of account and income tax

Deferred tax assets

Expenses claimed for tax purpose on payment basis 218.53 (26.47) (70.07) 121.99

Allowance for doubtful debts and advances 223.72 (81.55) - 142.17

Unabsorbed depreciation/carried forward losses 2,946.51 (2,946.51) - -

MAT Credit entitlement - 5,072.14 - 5,072.14

Others - 7.44 - 7.44

Deferred tax charge 1,948.89 (70.07) 5,343.74

Net deferred tax assets 1,931.70 3,810.51

229