Page 227 - FBL AR 2019-20

P. 227

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

Notes to the Consolidated financial statements for the year ended March 31, 2020

56 Financial risk management objectives and policies (contd.)

ii) Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market

interest rate. The Group’s exposure to the risk of changes in market interest rates relates primarily to the Group’s long-term and short

term borrowings obligations with floating interest rates.

The Group manages it’s interest rate risk by having a balanced portfolio of fixed and variable rate long term and short term

borrowings.

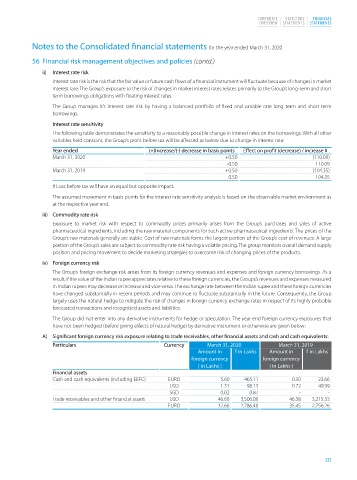

Interest rate sensitivity

The following table demonstrates the sensitivity to a reasonably possible change in interest rates on the borrowings. With all other

variables held constant, the Group’s profit before tax will be affected as below due to change in interest rate:

Year ended (+)Increase/(-) decrease in basis points Effect on profit (decrease) / increase #

March 31, 2020 +0.50 (110.09)

-0.50 110.09

March 31, 2019 +0.50 (104.35)

-0.50 104.35

# Loss before tax will have an equal but opposite impact.

The assumed movement in basis points for the interest rate sensitivity analysis is based on the observable market environment as

at the respective year end.

iii) Commodity rate risk

Exposure to market risk with respect to commodity prices primarily arises from the Group’s purchases and sales of active

pharmaceutical ingredients, including the raw material components for such active pharmaceutical ingredients. The prices of the

Group’s raw materials generally are stable. Cost of raw materials forms the largest portion of the Group’s cost of revenues. A large

portion of the Group’s sales are subject to commodity rate risk having a volatile pricing. The group monitors overall demand supply

position and pricing movement to decide marketing strategies to overcome risk of changing prices of the products.

iv) Foreign currency risk

The Group’s foreign exchange risk arises from its foreign currency revenues and expenses and foreign currency borrowings. As a

result, if the value of the Indian rupee appreciates relative to these foreign currencies, the Groups’s revenues and expenses measured

in Indian rupees may decrease or increase and vice-versa. The exchange rate between the Indian rupee and these foreign currencies

have changed substantially in recent periods and may continue to fluctuate substantially in the future. Consequently, the Group

largely uses the natural hedge to mitigate the risk of changes in foreign currency exchange rates in respect of its highly probable

forecasted transactions and recognised assets and liabilities.

The Group did not enter into any derivative instruments for hedge or speculation. The year end foreign currency exposures that

have not been hedged (before giving effects of natural hedge) by derivative instrument or otherwise are given below:

A) Significant foreign currency risk exposure relating to trade receivables, other financial assets and cash and cash equivalents:

Particulars Currency March 31, 2020 March 31, 2019

Amount in H in Lakhs Amount in H in Lakhs

foreign currency foreign currency

( in Lakhs ) ( in Lakhs )

Financial assets

Cash and cash equivalents (including EEFC) EURO 5.60 465.11 0.30 23.66

USD 1.31 98.13 0.72 49.99

SGD 0.02 0.87 - -

Trade receivables and other financial assets USD 46.68 3,506.00 46.38 3,215.33

EURO 32.66 2,786.40 35.45 2,756.26

225