Page 226 - FBL AR 2019-20

P. 226

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Consolidated financial statements for the year ended March 31, 2020

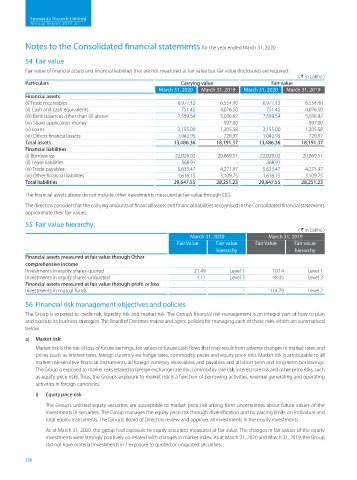

54 Fair value

Fair value of financial assets and financial liabilities that are not measured at fair value but fair value disclosures are required:

( H in Lakhs )

Particulars Carrying value Fair value

March 31, 2020 March 31, 2019 March 31, 2020 March 31, 2019

Financial assets

(i) Trade receivables 6,977.42 6,554.40 6,977.42 6,554.40

(ii) Cash and cash equivalents 751.45 4,076.50 751.45 4,076.50

(iii) Bank balances other than (ii) above 2,559.54 5,036.92 2,559.54 5,036.92

(iv) Share application money - 597.00 - 597.00

(v) Loans 2,155.00 1,205.58 2,155.00 1,205.58

(vi) Others financial assets 1,042.95 720.97 1,042.95 720.97

Total assets 13,486.36 18,191.37 13,486.36 18,191.37

Financial liabilities

(i) Borrowings 22,029.02 20,869.51 22,029.02 20,869.51

(ii) Lease liabilities 368.91 - 368.91 -

(iii) Trade payables 5,633.47 4,271.97 5,633.47 4,271.97

(iv) Other financial liabilities 1,616.15 3,109.75 1,616.15 3,109.75

Total liabilities 29,647.55 28,251.23 29,647.55 28,251.23

The financial assets above do not include other investments measured at fair value through OCI.

The directors consider that the carrying amounts of financial assets and financial liabilities recognised in the Consolidated financial statements

approximate their fair values.

55 Fair value hierarchy:

( H in Lakhs )

March 31, 2020 March 31, 2019

Fair Value Fair value Fair Value Fair value

hierarchy hierarchy

Financial assets measured at fair value through Other

comprehensive income

Investments in equity shares-quoted 21.49 Level 1 10.14 Level 1

Investments in equity shares-unquoted 4.11 Level 3 48.05 Level 3

Financial assets measured at fair value through profit or loss

Investments in mutual funds - - 114.79 Level 2

56 Financial risk management objectives and policies

The Group is exposed to credit risk, liquidity risk and market risk. The Group’s financial risk management is an integral part of how to plan

and execute its business strategies. The Board of Directors review and agree policies for managing each of these risks, which are summarised

below.

a) Market risk:

Market risk is the risk of loss of future earnings, fair values or future cash flows that may result from adverse changes in market rates and

prices (such as interest rates, foreign currency exchange rates, commodity prices and equity price risk). Market risk is attributable to all

market risk-sensitive financial instruments, all foreign currency receivables and payables and all short term and long-term borrowings.

The Group is exposed to market risks related to foreign exchange rate risk, commodity rate risk, interest rate risk and other price risks, such

as equity price risks. Thus, the Group’s exposure to market risk is a function of borrowing activities, revenue generating and operating

activities in foreign currencies.

i) Equity price risk

The Group’s unlisted equity securities are susceptible to market price risk arising form uncertainties about future values of the

investments in securities. The Group manages the equity price risk through diversification and by placing limits on individual and

total equity instruments. The Group’s Board of Directors review and approve, all investments in the equity investments.

As at March 31, 2020, the group had exposure to equity securities measured at fair value. The changes in fair values of the equity

investments were strongly positively co-related with changes in market index. As at March 31, 2020 and March 31, 2019, the Group

did not have material investments in / exposure to quoted or unquoted securities.

224