Page 228 - FBL AR 2019-20

P. 228

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Consolidated financial statements for the year ended March 31, 2020

56 Financial risk management objectives and policies (contd.)

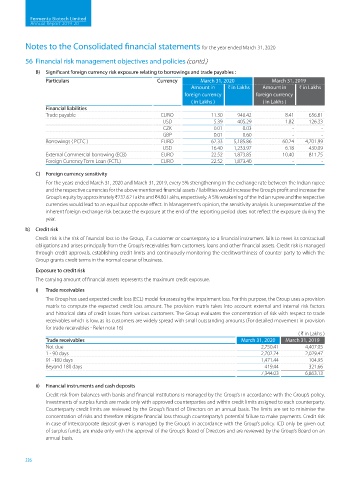

B) Significant foreign currency risk exposure relating to borrowings and trade payables :

Particulars Currency March 31, 2020 March 31, 2019

Amount in H in Lakhs Amount in H in Lakhs

foreign currency foreign currency

( in Lakhs ) ( in Lakhs )

Financial liabilities

Trade payable EURO 11.30 940.42 8.41 656.81

USD 5.39 405.29 1.82 126.33

CZK 0.01 0.03 - -

GBP 0.01 0.60 - -

Borrowings ( PCFC ) EURO 62.33 5,185.86 60.24 4,701.99

USD 16.40 1,233.97 6.18 430.09

External Commercial borrowing (ECB) EURO 22.52 1,873.85 10.40 811.75

Foreign Currency Term Loan (FCTL) EURO 22.52 1,873.40 - -

C) Foreign currency sensitivity

For the years ended March 31, 2020 and March 31, 2019, every 5% strengthening in the exchange rate between the Indian rupee

and the respective currencies for the above mentioned financial assets / liabilities would increase the Group’s profit and increase the

Group’s equity by approximately H232.62 Lakhs and H4.80 Lakhs, respectively. A 5% weakening of the Indian rupee and the respective

currencies would lead to an equal but opposite effect. In Management’s opinion, the sensitivity analysis is unrepresentative of the

inherent foreign exchange risk because the exposure at the end of the reporting period does not reflect the exposure during the

year.

b) Credit risk

Credit risk is the risk of financial loss to the Group, if a customer or counterparty to a financial instrument fails to meet its contractual

obligations and arises principally from the Group’s receivables from customers, loans and other financial assets. Credit risk is managed

through credit approvals, establishing credit limits and continuously monitoring the creditworthiness of counter party to which the

Group grants credit terms in the normal course of business.

Exposure to credit risk

The carrying amount of financial assets represents the maximum credit exposure.

i) Trade receivables

The Group has used expected credit loss (ECL) model for assessing the impairment loss. For this purpose, the Group uses a provision

matrix to compute the expected credit loss amount. The provision matrix takes into account external and internal risk factors

and historical data of credit losses from various customers. The Group evaluates the concentration of risk with respect to trade

receivables which is low, as its customers are widely spread with small outstanding amounts (For detailed movement in provision

for trade receivables - Refer note 16)

( H in Lakhs )

Trade receivables March 31, 2020 March 31, 2019

Not due 2,750.41 4,407.05

1 - 90 days 2,702.74 2,029.47

91 -180 days 1,471.44 104.95

Beyond 180 days 419.44 321.66

7,344.03 6,863.13

ii) Financial instruments and cash deposits

Credit risk from balances with banks and financial institutions is managed by the Group’s in accordance with the Group’s policy.

Investments of surplus funds are made only with approved counterparties and within credit limits assigned to each counterparty.

Counterparty credit limits are reviewed by the Group’s Board of Directors on an annual basis. The limits are set to minimise the

concentration of risks and therefore mitigate financial loss through counterparty’s potential failure to make payments. Credit risk

in case of Intercorporate deposit given is managed by the Group’s in accordance with the Group’s policy. ICD only be given out

of surplus funds, are made only with the approval of the Group’s Board of Directors and are reviewed by the Group’s Board on an

annual basis.

226