Page 230 - FBL AR 2019-20

P. 230

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Consolidated financial statements for the year ended March 31, 2020

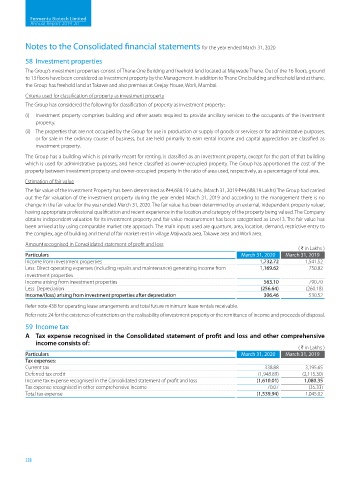

58 Investment properties

The Group’s investment properties consist of Thane One Building and freehold land located at Majiwade Thane. Out of the 16 floors, ground

to 13 floors have been considered as Investment property by the Management. In addition to Thane One building and freehold land at thane,

the Group has freehold land at Takawe and also premises at Ceejay House, Worli, Mumbai.

Criteria used for classification of property as investment property

The Group has considered the following for classification of property as investment property:

(i) Investment property comprises building and other assets required to provide ancillary services to the occupants of the investment

property.

(ii) The properties that are not occupied by the Group for use in production or supply of goods or services or for administrative purposes,

or for sale in the ordinary course of business, but are held primarily to earn rental income and capital appreciation are classified as

investment property.

The Group has a building which is primarily meant for renting, is classified as an investment property, except for the part of that building

which is used for administrative purposes, and hence classified as owner-occupied property. The Group has apportioned the cost of the

property between investment property and owner-occupied property in the ratio of area used, respectively, as a percentage of total area.

Estimation of fair value

The fair value of the Investment Property has been determined as H44,688.19 Lakhs. (March 31, 2019 H44,688.19 Lakhs) The Group had carried

out the fair valuation of the investment property during the year ended March 31, 2019 and according to the management there is no

change in the fair value for the year ended March 31, 2020. The fair value has been determined by an external, independent property valuer,

having appropriate professional qualification and recent experience in the location and category of the property being valued. The Company

obtains independent valuation for its investment property and fair value measurement has been categorised as Level 3. The fair value has

been arrived at by using comparable market rate approach. The main inputs used are quantum, area, location, demand, restrictive entry to

the complex, age of building and trend of fair market rent in village Majiwada area, Takawe area and Worli area.

Amount recognised in Consolidated statement of profit and loss

( H in Lakhs )

Particulars March 31, 2020 March 31, 2019

Income from investment properties 1,732.72 1,541.52

Less: Direct operating expenses (including repairs and maintenance) generating income from 1,169.62 750.82

investment properties

Income arising from investment properties 563.10 790.70

Less: Depreciation (256.64) (260.18)

Income/(loss) arising from investment properties after depreciation 306.46 530.52

Refer note 43B for operating lease arrangements and total future minimum lease rentals receivable.

Refer note 24 for the existence of restrictions on the realisability of investment property or the remittance of income and proceeds of disposal.

59 Income tax

A Tax expense recognised in the Consolidated statement of profit and loss and other comprehensive

income consists of:

( H in Lakhs )

Particulars March 31, 2020 March 31, 2019

Tax expenses:

Current tax 338.88 3,195.65

Deferred tax credit (1,948.89) (2,115.30)

Income tax expense recognised in the Consolidated statement of profit and loss (1,610.01) 1,080.35

Tax expense recognised in other comprehensive income 70.07 (35.33)

Total tax expense (1,539.94) 1,045.02

228