Page 51 - 89326_NSAA_JournalSummer2019

P. 51

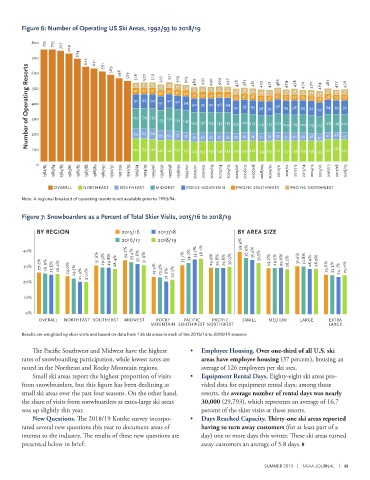

Figure 6: Number of Operating US Ski Areas, 1992/93 to 2018/19

800 735 735 727 709

700 674 622 611 591 569 546 529 518 520 519 507 521 509 503

Number of Operating Resorts 400 137 134 135 40 40 40 39 140 136 135 135 135 122 478 120 119 481 116 115 120 486 119 119 120 119 113 464 118 116 116 476

600

493

492

494

489

490

485

481

478

474

472

473

471

470

470

35

35

35

38

36

34

38

500

35

35

35

35

36

43

41

39

41

38

37

39

35

38

37

34

38

33

35

39

39

38

39 40 40 39

39

37

41

38

38

38

37

35

39

35

37

37

37

36

38

91

93 94

90 90 94

91

90 93 92 96 94

96

93 95

94

93 93

92

96 93

93 96 94 94

93

300

135 151 145 143

64 65 68

200

63 60 57

47

47 47

53

53

56

54

54

51

53

55

55

55

51

56

56

50 49 48 47

100

0 150 150 146 140 142 141 137 129 132 133 134 134 134 139 138 134 135 141 137 138 139 138 135 147 146 145

1982/83 1983/84 1984/85 1985/86 1986/87 1987/88 1988/89 1989/90 1990/91 1991/92 1992/93 1993/94 1994/95 1995/96 1996/97 1997/98 1998/99 1999/00 2000/01 2001/02 2002/03 2003/04 2004/05 2005/06 2006/07 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19

OVERALL NORTHEAST SOUTHEAST MIDWEST ROCKY MOUNTAIN PACIFIC SOUTHWEST PACIFIC NORTHWEST

Note: A regional breakout of operating resorts is not available prior to 1993/94.

Figure 7: Snowboarders as a Percent of Total Skier Visits, 2015/16 to 2018/19

BY REGION 2015/16 2017/18 BY AREA SIZE

2016/17 2018/19 39.4%

40% 34.2% 35.7% 36.1% 36.0% 35.4%

31.6% 29.9% 29.8% 33.4% 32.6% 31.9% 33.7% 34.7% 29.9% 29.8% 29.8% 30.3% 33.5% 29.2% 29.5% 29.6% 31.6% 30.8% 28.9%

27.2% 28.4% 28.2% 28.9%

30% 26.9% 25.8% 26.2% 24.0% 23.3% 23.5% 23.3% 22.5% 25.6% 25.2% 24.1% 25.0%

20% 21.4% 21.0% 21.6%

10%

0%

OVERALL NORTHEAST SOUTHEAST MIDWEST ROCKY PACIFIC PACIFIC SMALL MEDIUM LARGE EXTRA

MOUNTAIN SOUTHWEST NORTHWEST LARGE

Results are weighted by skier visits and based on data from 136 ski areas in each of the 2015/16 to 2018/19 seasons

The Pacific Southwest and Midwest have the highest • Employee Housing. Over one-third of all U.S. ski

rates of snowboarding participation, while lowest rates are areas have employee housing (37 percent), housing an

noted in the Northeast and Rocky Mountain regions. average of 126 employees per ski area.

Small ski areas report the highest proportion of visits • Equipment Rental Days. Eighty-eight ski areas pro-

from snowboarders, but this figure has been declining at vided data for equipment rental days; among those

small ski areas over the past four seasons. On the other hand, resorts, the average number of rental days was nearly

the share of visits from snowboarders at extra-large ski areas 30,000 (29,793), which represents an average of 16.7

was up slightly this year. percent of the skier visits at these resorts.

New Questions. The 2018/19 Kottke survey incorpo- • Days Reached Capacity. Thirty-one ski areas reported

rated several new questions this year to document areas of having to turn away customers (for at least part of a

interest to the industry. The results of these new questions are day) one or more days this winter. These ski areas turned

presented below in brief: away customers an average of 5.8 days.

SUMMER 2019 | NSAA JOURNAL | 49