Page 231 - Corporate Finance PDF Final new link

P. 231

BRILLIANT’S Long Term Financing and Valuation of Goodwill & Shares 231

Depreciation Fund ` 60,000. / S>o{à{eEeZ ’§$S> < 60,000

Creditors ` 50,000. / H«o${S>Q>g© < 50000

Assets side of Balance Sheet includes preliminary expenses ` 20,000

~¡b|g erQ> H$m AgoQ²>g gmBS> àmW{‘H$ ê$n go E³gn|gog < 20,000 gpå‘{bV H$aVm h¡&

Market value of assets is ` 70,000 more than the book value.

AgoQ²>g H$s ‘mH}$Q> d¡ë¶y < 70,000 h¡ Omo ~wH$ d¡ë¶y go A{YH$ h¡&

Profits for the last three years after 40% tax were:

40% Q>¡³g Ho$ níMmV² {nN>bo VrZ df© Ho$ {bE bm^ Wo…

` 75,000; ` 84,000 and ` 1,14,000 respectively.

Fair return on capital employed in this type of business is estimated at 10%.

ì¶mnma Ho$ Bg àH$ma ‘| à¶w³V H¡${nQ>b na C{MV [aQ>Z© 10% na AZw‘mZ bJm¶m J¶m h¡&

You are required to calculate the value of goodwill by capitalization of super profit. (Take

weighted average profit).

AmnH$mo gwna àm°{’$Q> Ho$ H¡${nQ>bmBOoeZ Ûmam JwS>{db H$s JUZm H$aZm h¡& (doQ>oS> EdaoO àm°{’$Q> br{OE)&

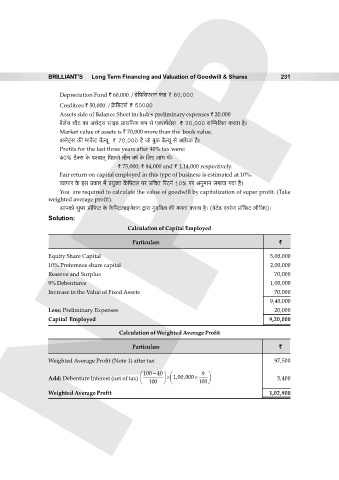

Solution: NPP

Calculation of Capital Employed

Particulars `

Equity Share Capital 5,00,000

10% Preference share capital 2,00,000

Reserve and Surplus 70,000

9% Debentures 1,00,000

Increase in the Value of Fixed Assets 70,000

9,40,000

Less: Preliminary Expenses 20,000

Capital Employed 9,20,000

Calculation of Weighted Average Profit

Particulars `

Weighted Average Profit (Note 1) after tax 97,500

100 40 9

Add: Debenture Interest (net of tax) 1,00,000 5,400

100 100

Weighted Average Profit 1,02,900