Page 232 - Corporate Finance PDF Final new link

P. 232

NPP

232 Corporate Finance BRILLIANT’S

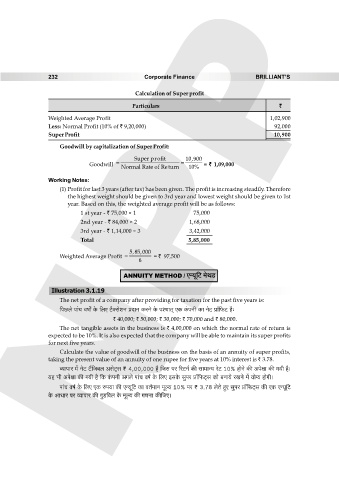

Calculation of Super profit

Particulars `

Weighted Average Profit 1,02,900

Less: Normal Profit (10% of ` 9,20,000) 92,000

Super Profit 10,900

Goodwill by capitalization of Super Profit:

Super profit 10,900

Goodwill = ` 1,09,000

Normal Rate of Return 10%

Working Notes:

(1) Profit for last 3 years (after tax) has been given. The profit is increasing steadily. Therefore

the highest weight should be given to 3rd year and lowest weight should be given to 1st

year. Based on this, the weighted average profit will be as follows:

1 st year - ` 75,000 × 1 75,000

2nd year - ` 84,000 × 2 1,68,000

3rd year - ` 1,14,000 × 3 3,42,000

Total 5,85,000

5,85,000

Weighted Average Profit = ` 97,500

6

ANNUITY METHOD / Eݶy{Q> ‘oWS>

Illustration 3.1.19

The net profit of a company after providing for taxation for the past five years is:

{nN>bo nm§M dfm] Ho$ {bE Q>¡³goeZ àXmZ H$aZo Ho$ níMmV² EH$ H§$nZr H$m ZoQ> àm°{’$Q> h¡…

` 40,000; ` 50,000; ` 30,000; ` 70,000 and ` 80,000.

The net tangible assets in the business is ` 4,00,000 on which the normal rate of return is

expected to be 10%. It is also expected that the company will be able to maintain its super profits

for next five years.

Calculate the value of goodwill of the business on the basis of an annuity of super profits,

taking the present value of an annuity of one rupee for five years at 10% interest is ` 3.78.

ì¶mnma ‘| ZoQ> Q>¢{O~b AgoQ²>g < 4,00,000 h¡ {Og na [aQ>Z© H$s gm‘mݶ aoQ> 10% hmoZo H$s Anojm H$s J¶r h¡&

¶h ^r Anojm H$s J¶r h¡ {H$ H§$nZr AJbo nm§M df© Ho$ {bE BgHo$ gwna àm°{’$Q²>g H$mo ~Zm¶o aIZo ‘| ¶mo½¶ hmoJr&

nm§M df© Ho$ {bE EH$ én¶m H$s Eݶy{Q> H$m dV©‘mZ ‘yë¶ 10% na < 3.78 boVo hþE gwna àm°{’$Q²>g H$s EH$ Eݶy{Q>

Ho$ AmYma na ì¶mnma H$s JwS>{db Ho$ ‘yë¶ H$s JUZm H$s{OE&