Page 151 - Theoretical and Practical Interpretation of Investment Attractiveness

P. 151

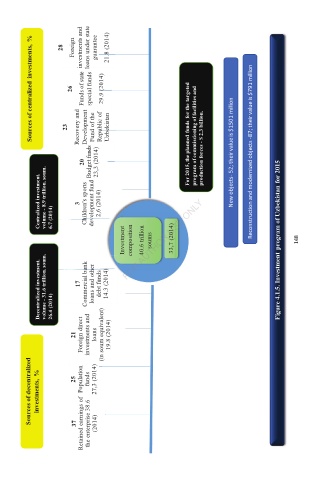

Sources of centralized investments, % 28 26 Foreign d investments and Funds of state loans under state te t special funds s guarantee 29.9 (2014) ) 21.8 (2014) )

Recovery and

23

unds Fund of the 14) Republic of Uzbekistan ( For 2015, the planned funds for the targeted program of commissioning of facilities and production forces - $ 2.3 billion. New objects- 52; their value is $1501 million Reconstruc#on and modernized objects -87; their value is $791 million

20 development fund Budget funds Development 23,3 (2014)

Centralized investment. volume - 8.9 trillion. soum. 6.7 (2014) 3 s Children's sports d 2,6 (2014)

Investment composition 40.6 trillion soums 33,7 (2014) Figure 4.1.5. Investment program of Uzbekistan for 2015 148

Decentralized investment. volume - 31.6 trillion. soum. 26.4 (2014) 17 Commercial bank C loans and other debt funds 14.3 (2014)

21 Foreign direct investments and loans (in soum equivalent) (i 19.8 (2014)

Sources of decentralized investments, % 25 37 Population P Retained earnings of funds the enterprise 38.6 27,3 (2014) 2 (2014)