Page 10 - annualReport_jmm

P. 10

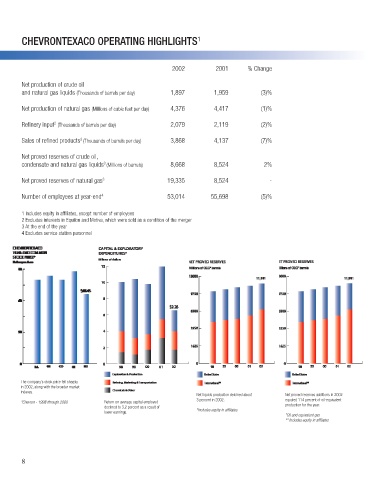

CHEVRONTEXACO OPERATING HIGHLIGHTS 1

2002 2001 % Change

Net production of crude oil

and natural gas liquids (Thousands of barrels per day) 1,897 1,959 (3)%

Net production of natural gas (Millions of cubic feet per day) 4,376 4,417 (1)%

Refinery input (Thousands of barrels per day) 2,079 2,119 (2)%

2

Sales of refined products (Thousands of barrels per day) 3,868 4,137 (7)%

2

Net proved reserves of crude oil,

condensate and natural gas liquids (Millions of barrels) 8,668 8,524 2%

3

Net proved reserves of natural gas 3 19,335 8,524 -

4

Number of employees at year-end 53,014 55,698 (5)%

1 Includes equity in affiliates, except number of employees

2 Excludes interests in Equilon and Motiva, which were sold as a condition of the merger

3 At the end of the year

4 Excludes service station personnel

The company’s stock price fell sharply

in 2002, along with the broader market

indexes.

Net liquids production delcined about Net proved reserves additions in 2002

3 percent in 2002. equaled 114 percent of oil-equivalent

*Chevron - 1998 through 2000 Return on average capital employed production for the year.

declined to 3.2 percent as a result of

lower earnings. *Includes equity in affiliates

*Oil and equivalent gas

** Includes equity in affiliates

8