Page 9 - annualReport_jmm

P. 9

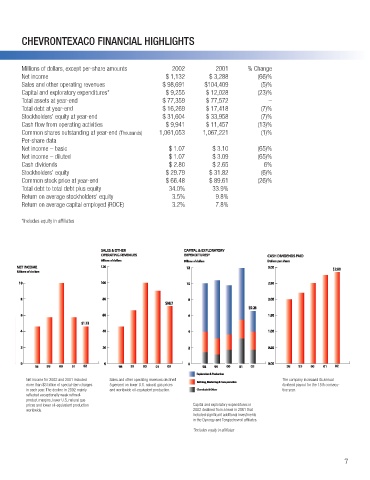

CHEVRONTEXACO FINANCIAL HIGHLIGHTS

Millions of dollars, except per-share amounts 2002 2001 % Change

Net income $ 1,132 $ 3,288 (66)%

Sales and other operating revenues $ 98,691 $104,409 (5)%

Capital and exploratory expenditures* $ 9,255 $ 12,028 (23)%

Total assets at year-end $ 77,359 $ 77,572 –

Total debt at year-end $ 16,269 $ 17,418 (7)%

Stockholders’ equity at year-end $ 31,604 $ 33,958 (7)%

Cash flow from operating activities $ 9,941 $ 11,457 (13)%

Common shares outstanding at year-end (Thousands) 1,061,053 1,067,221 (1)%

Per-share data

Net income – basic $ 1.07 $ 3.10 (65)%

Net income – diluted $ 1.07 $ 3.09 (65)%

Cash dividends $ 2.80 $ 2.65 6%

Stockholders’ equity $ 29.79 $ 31.82 (6)%

Common stock price at year-end $ 66.48 $ 89.61 (26)%

Total debt to total debt plus equity 34.0% 33.9%

Return on average stockholders’ equity 3.5% 9.8%

Return on average capital employed (ROCE) 3.2% 7.8%

*Includes equity in affiliates

Net income for 2002 and 2001 included Sales and other operating revenues declined The company increased its annual

more than $3 billion of special-item charges 5 percent on lower U.S. natural gas prices dividend payout for the 15th consecu-

in each year. The decline in 2002 mainly and worldwide oil-equivalent production. tive year.

reflected exceptionally weak refined-

product margins, lower U.S. natural gas

prices and lower oil-equivalent production Capital and exploratory expenditures in

worldwide. 2002 declined from a level in 2001 that

included significant additional investments

in the Dynergy and Tengizchevroil affiliates.

*Includes equity in affiliates

7