Page 458 - Krugmans Economics for AP Text Book_Neat

P. 458

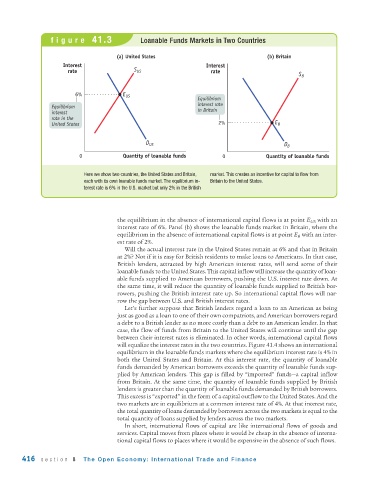

figure 41.3 Loanable Funds Markets in Two Countries

(a) United States (b) Britain

Interest Interest

rate S US rate

S B

6% E US

Equilibrium

interest rate

Equilibrium

interest in Britain

rate in the

United States 2% E B

D US D B

0 Quantity of loanable funds 0 Quantity of loanable funds

Here we show two countries, the United States and Britain, market. This creates an incentive for capital to flow from

each with its own loanable funds market. The equilibrium in- Britain to the United States.

terest rate is 6% in the U.S. market but only 2% in the British

the equilibrium in the absence of international capital flows is at point E US with an

interest rate of 6%. Panel (b) shows the loanable funds market in Britain, where the

equilibrium in the absence of international capital flows is at point E B with an inter-

est rate of 2%.

Will the actual interest rate in the United States remain at 6% and that in Britain

at 2%? Not if it is easy for British residents to make loans to Americans. In that case,

British lenders, attracted by high American interest rates, will send some of their

loanable funds to the United States. This capital inflow will increase the quantity of loan-

able funds supplied to American borrowers, pushing the U.S. interest rate down. At

the same time, it will reduce the quantity of loanable funds supplied to British bor-

rowers, pushing the British interest rate up. So international capital flows will nar-

row the gap between U.S. and British interest rates.

Let’s further suppose that British lenders regard a loan to an American as being

just as good as a loan to one of their own compatriots, and American borrowers regard

a debt to a British lender as no more costly than a debt to an American lender. In that

case, the flow of funds from Britain to the United States will continue until the gap

between their interest rates is eliminated. In other words, international capital flows

will equalize the interest rates in the two countries. Figure 41.4 shows an international

equilibrium in the loanable funds markets where the equilibrium interest rate is 4% in

both the United States and Britain. At this interest rate, the quantity of loanable

funds demanded by American borrowers exceeds the quantity of loanable funds sup-

plied by American lenders. This gap is filled by “imported” funds—a capital inflow

from Britain. At the same time, the quantity of loanable funds supplied by British

lenders is greater than the quantity of loanable funds demanded by British borrowers.

This excess is “exported” in the form of a capital outflow to the United States. And the

two markets are in equilibrium at a common interest rate of 4%. At that interest rate,

the total quantity of loans demanded by borrowers across the two markets is equal to the

total quantity of loans supplied by lenders across the two markets.

In short, international flows of capital are like international flows of goods and

services. Capital moves from places where it would be cheap in the absence of interna-

tional capital flows to places where it would be expensive in the absence of such flows.

416 section 8 The Open Economy: Inter national Trade and Finance