Page 220 - UUBO PE Summit 2020 - Materials

P. 220

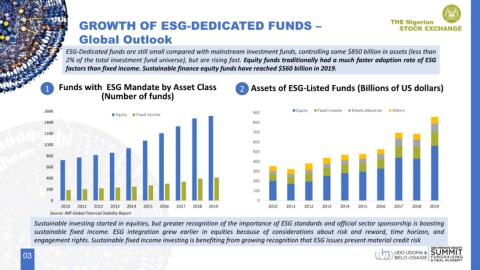

GROWTH OF ESG-DEDICATED FUNDS –

Global Outlook

ESG-Dedicated funds are still small compared with mainstream investment funds, controlling some $850 billion in assets (less than

2% of the total investment fund universe), but are rising fast. Equity funds traditionally had a much faster adoption rate of ESG

factors than fixed income. Sustainable finance equity funds have reached $560 billion in 2019.

1 Funds with ESG Mandate by Asset Class 2 Assets of ESG-Listed Funds (Billions of US dollars)

(Number of funds)

1600 900 Equity Fixed income Mixed allocation Others

Equity Fixed income

1400 800

1200 700

600

1000

500

800

400

600

300

400

200

200 100

0 0

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Source: IMF Global Financial Stability Report

Sustainable investing started in equities, but greater recognition of the importance of ESG standards and official sector sponsorship is boosting

sustainable fixed income. ESG integration grew earlier in equities because of considerations about risk and reward, time horizon, and

engagement rights. Sustainable fixed income investing is benefiting from growing recognition that ESG issues present material credit risk

03