Page 181 - Records of Bahrain (6)_Neat

P. 181

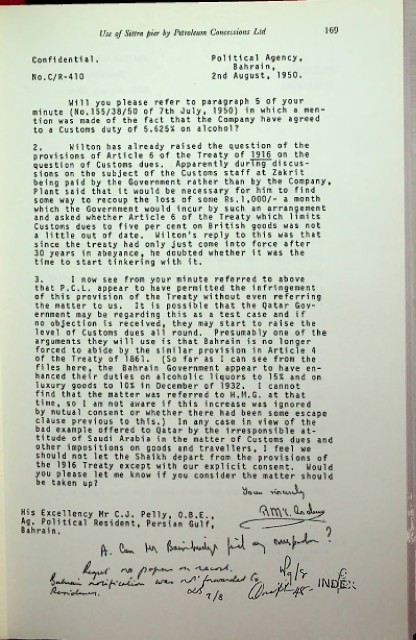

Use of Sittra pier by Petroleum Conccssio?is Ltd 169

Confidential. Political Agency,

Bahrain,

No.C/R-410 2nd August, 1950.

Will you please refer to paragraph 5 of your

minute (No.155/38/50 of 7th July, 1950) in which a men

tion was made of the fact that the Company have agreed

to a Customs duty of 5,625% on alcohol?

2. Wilton has already raised the question of the

provisions of Article 6 of the Treaty of 1916 on the

question of Customs dues. Apparently during discus

sions on the subject of the Customs staff at Zakrit

being paid by the Government rather than by the Company,

Plant said that it would be necessary for him to find

some way to recoup the loss of some Rs.1,000/- a month

which the Government would incur by such an arrangement

and asked whether Article 6 of the Treaty which limits

Customs dues to five per cent on British goods was not

a little out of date. Wilton's reply to this was that

since the treaty had only just come into force after

30 years in abeyance, he doubted whether it was the

time to start tinkering with it.

3. I now see from your minute referred to above

that P.C.L. appear to have permitted the infringement

of this provision of the Treaty without even referring

the matter to us. It is possible that the Qatar Gov

ernment may be regarding this as a test case and if

no objection is received, they may start to raise the

level of Customs dues all round. Presumably one of the

arguments they will use is that Bahrain is no longer

forced to abide by the similar provision in Article 4

of the Treaty of 1861. (So far as I can see from the

files here, the Bahrain Government appear to have en

hanced their duties on alcoholic liquors to 15% and on

luxury goods to 10% in December of 1932. I cannot

find that the matter was referred to H.M.G, at that

time, so I am not aware if this increase was ignored

by mutual consent or whether there had been some escape

clause previous to this.) In any case in view of the

bad example offered to Qatar by the irresponsible at

titude of Saudi Arabia in the matter of Customs dues and

other impositions on goods and travellers, I feel we

should not let the Shaikh depart from the provisions of

the 1916 Treaty except with our explicit consent. Would

you please let me know if you consider the matter should

be taken up?

l)o\Xw

)

His Excellency Mr C.J. Pelly, O.B.E.,

Ag. Political Resident, Persian Gulf,

Bahrain.

tLyM' ™ y\-C- .