Page 715 - PERSIAN 8 1912_1920_Neat

P. 715

ML

FOB THE YBA.B 1019.

brought under the Sultan’s effective control. The situation w, however,

complicated by the hostility of the Imam in interior Oman and of tbe anciKU

of Bireimi. There are demands for slaves in both of these places and once there,

the possibility of getting them out or of bringing pressure to bear is small.

The traffic is, however, very small and a certain proportion of slaves manage

to escapo.

Total imports amounted to Rb. 43,49,471 and export B^36*8^42^*

Trade. 2 i,68,978 respectively, of the previous year.

It must be remembered that these figures only inaccurately represent Muscat

and Muttrah. Sur has 80 trading dhows which make an average profit of

Rs. 10,000 per year eacb, and there are numerous poits on the Bafcineh Coast each

with its colony of Indian merchants and by no means insignificant trade. Nq

record is available of this trade and it must be fully half as much as that of

Muscat and Muttrah.

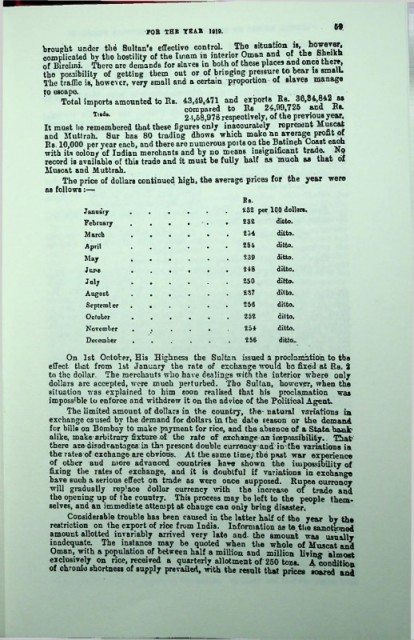

The price of dollars continued high, the average prices for the year were

as follows:—

Fb.

January a32 per 100 dollars.

February 232 ditto.

March 234 ditto.

April 254 ditto.

May 239 ditto.

Jure 248 ditto.

J uly 250 ditto.

Augost 237 ditto.

Septemler 258 ditto.

October 252 ditto.

November 254 ditto.

December 256 ditto-

On 1st October, His Highness the Sultan issued a proclamation to the

effect that from 1st January" the rate of exchange would be fixed at Rs. 2

to the dollar. The merchauts who have dealings with the interior where only

dollars are accepted, were much perturbed. Tho Sultan, however, when the

situation was explained to him soon realised that his proclamation was

impossible to enforce and withdrew it on. the advice of the Political Agent.

The limited amount of dollars in the country, the- natural variations in

exchange caused by the demand for dollars in the date season or the demand

for bills on Bombay to make payment for rice, and the absence of a State, hank*

alike, make arbitrary fixture of the rate of exchange an impossibility.. Thafr

there are disadvantages in th«. presont double currency and in vlhe variations in

the rates of exchange are obvious. At the same time/ the past war experience

of other and more advanced countries have shown the impossibility of

fixing the rales of exchange, and it is doubtful if variations in exchange

have such a serious effect on trade as were once supposed. Rupee currency

will gradually replace dollar currency with the increase of trade and

the opening up of the country. This process may be left to the people them

selves, and an immediate attempt at change can only bring disaster.

Considerable trouble has been caused in the latter half of the year by the

restriction on the export of rice from India. Information as te the sanctioned

amount allotted invariably arrived very late and. the amount was usually

inadequate. The instance may be quoted when the whole of Muscat and

Oman, with a population of between half a million and million livin® almost

exclusively on rice, received a quarterly allotment of 250 tons. A condition

of chrome shortness of supply prevailed, with the result that prices soared and