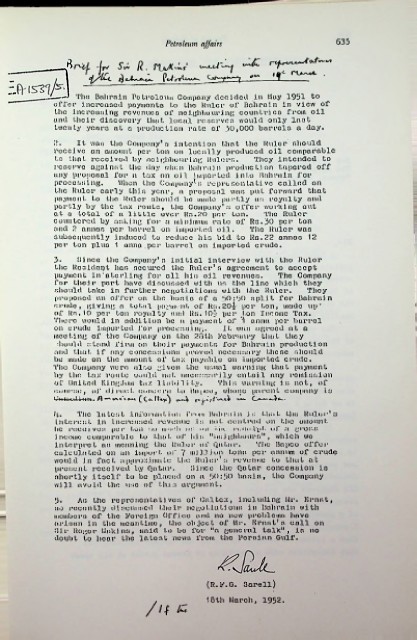

Page 245 - Records of Bahrain (7) (ii)_Neat

P. 245

Petroleum affairs 635

r'-t'js -jrs $ v* R. rLevA'^f'

1 ■i rUA^t. .

UaAs •t

Tho Bahrain Petroleum Company decided in May 1951 to

offer incroaood payments t.o tho Hiller of Bahrain in view of

the increasing revenues of neighbouring countries from oil

and their discovery that local renerveo would only’loot

twenty years at a production rate of 30,000 barrels a day.

2. It was tho Company's intention that the Rulor should

receive an amount per ton on locally produced oil comparable

to that received by neighbouring Rulers, They intended to

reserve against tho day when BahruJn production tapered off

uny proposal for n tax on oil imported into Bahrain for

processing. V/hen tho Company^:* representative called on

the Rulor early this year, a proposal wan put forward that

payment to tho Ruler should bo made partly as royalty and

partly by the tax route, the Company's offer working out

at a total of a little over Rn.20 per ton. The Rulor

countered by asking for a minimum rate of Ra.30 per ton

and 2 annas per barrel on imported oil. Tho Ruler was

subsequently induced to reduce bis bid to Rs.22 annao 12

per ton plus 1 anna per barrel on imported crudo.

3. Bince the Company's initial intervicw with tho Rulor

the Resident liar, secured the Ruler's agreement to accept

payment in'sterling for all his oil revenues, The Company

for their part have discussed with us the line which they

should take in further negotiations with the Ruler, They

proposed an offer on tho basis of a 50:50 split for Bahrain

crude, giving n tol.nl payment of Rs.20£- per ton, made up*

of Rn.10 per ton royalty and Rs. 10-J per tl.on Income Tax.

There would in addition be n payment of 3 anna por barrol

on crude imported for processing, It was agreed at a

meeting of the Company on the 28th February that they

should stand firm on their payments for Bahrain production

and that if any concessions proved necessary these should

he mudo on the amount of tax payable on imported crude.

Tho Company wore also given the usual warning that payment

by the tax route wuiild not necessarily entail any remission

of United Kingdom tax liability, This warning is not, of

course, of direr.I. concern to Rupee, whose parent company Is

UiO.1 Hi-fri. f\ *** (Ullty) ft } f Vvi-i

4. Tho latest informal, i on Prom Bahrain i s that the Ruler's

Lntcrcst in increased revenue .is not centred on the uinount

he receives per ton so msidi as. *oi tin: receipt of a gross

income comparable to that of his "neighbours", which wo

interpret as meaning the Ruler of Qatar, The Bnpco offer

calculated on an impost oJ* 7 million tons per annum of crude

would in fact approximate the Ruler* s. revenue to that at

present received by Qatar, Since the Qatar concession is

shortly itself to bo placed on a Ji0:*50 basis, tho Company

will avoid tho use of this argument.

5. As the representatives of Onltcx, including Mr. Ernst,

so recently discussed their negotiations in Bahrain with

members of the Foreign Office and no now problems hnvo

arisen in the meantime, tho object of Mr. Ernst's call on

Oir Roger Mold ns, said to bo for "a general talk" in no

doubt to hear the latent news from tho Persian Gulf.

(R.F.G. 3are11)

10th March, 1952.

A f &