Page 247 - Records of Bahrain (7) (ii)_Neat

P. 247

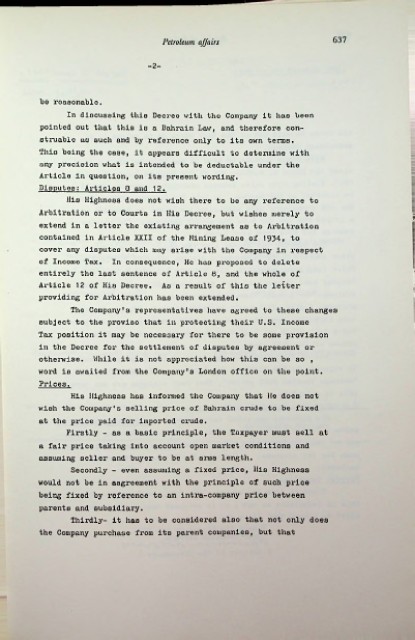

Petroleum affairs 637

-2-

bo reasonable.

In discussing this Decree with the Company it has been

pointed out that this is a Bahrain Law, and therefore con-

struablo as such and by reference only to its own terms.

This boing the case, it appears difficult to determine with

any precision what is intended to be deductable under the

Article in question, on its present wording.

Disputes: Articles Q and 12.

His Highness does not wish there to be any reference to

Arbitration or to Courts in His Decree, but wishes merely to

extend in a letter the existing arrangement as to Arbitration

contained in Article XXII of the Mining Lease of 1934, to

cover any disputes which may arise with the Company in x'espect

of Income Tax. In consequence, He has proposed to delete

entirely the last sentence of Article 8, and the whole of

Article 12 of His Decree. As a result of this the letter

providing for Arbitration has been extended. [

The Company's representatives have agreed to these changes

subject to the proviso that in protecting their U.S. Income

!

Tax position it may be necessary for there to be some provision

in the Decree for the settlement of disputes by agreement or

otherwise. While it is not appreciated how this can be so ,

word is awaited from the Company's London office on the point.

Prices.

His Highness has informed the Company that lie does not

wish the Company's selling price of Bahrain crude to be fixed

at the price paid for imported crude.

Firstly - as a basic principle, the Taxpayer must sell at

a fair price taking into account open market conditions and

assuming seller and buyer to be at arms length.

Secondly - even assuming a fixed price, His Highness

would not be in aagreement with the principle of such price

being fixed by reference to an intra-company price between

parents and subsidiary.

Thirdly- it has to be considered also that not only does

the Company purchase from its parent companies, but that