Page 242 - Records of Bahrain (7) (ii)_Neat

P. 242

I

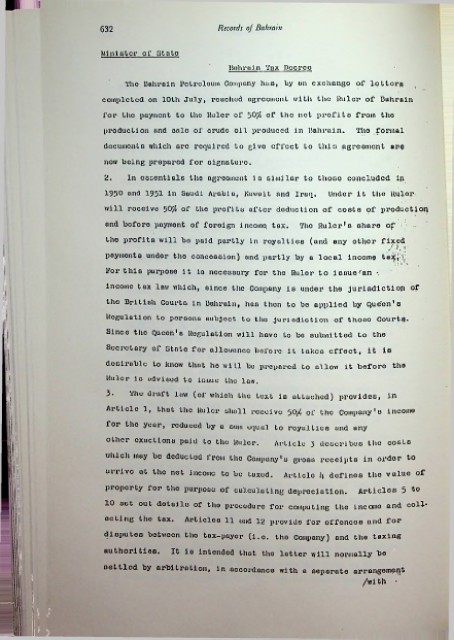

632 Records of Bahrain

Minister of Stale

Bahru in Tnx Decree

The Bahrain Petroleum Company has, by on exchange of Icttorq

completed on 10th July, rcuchod agreement with the Ruler of Bahrain

for the payment to the Ruler of $0% of the net profits fx'oin tho

production and oalc of crude oil produced in Bahrain. Tho formal

documents which are required to give effect to this agreement are

now being prepared for signature.

2. In oscentials the agreement lo similar to those concluded ip

195° and 1951 in Suudi Arabia, Kuwait and Iraq. Under it the Hqlor

will rocclve 50# of the profits after deduction of costs of production

;

and boforo payment of foreign incoinq tax. Tho Ruler*s share of

the profits will be paid partly in royalties (and any other fixed

//. |

payments under tho concession) and partly by a local income taifji.y

For this purpose it io nocessary for the Ruler to issue'an

income tax law which, since the Company is under the jurisdiction of

tho British Courts in Bahrain, has then to be applied by Queen1 o

Regulation to persons subject to the jurisdiction of those Courtq.

Since the Queen's Regulation will have to be submitted to the

Secretary of State for allowance before it takes effect, it is

I

desirable to know that he will be prepared to allow it before tho

Ruler io advised to issue the law.

3. The draft law (of which the text is attached) provides, in

Article 1, that the Ruler shall receive 501/ of the Company's income

for the year, reduced by a sum equal to royalties and any

other exuctions puid to the Ruler. Article 3 describes the costs

which muy be deducted from the Company's gross receipts in order to

arrive ut the net income to be tuxed. Article 4 defines the value of

property for the purpooe of calculating depreciation. Articles 5 to

10 set out detuilo of the procedure for computing the income and coll-

'L thG t0X' Arti°l00 11 und la provide for offoncoo and for

disputes between the tax-payer (i.c. the Company) and the taxing

authorities. It io Intended that the latter will normally be

nettled by arbitration, in accordance with a separate arrangement

/wlth •