Page 6 - FY21 BUDGET booklet for residents PRELIMINARY V 073120 FINAL

P. 6

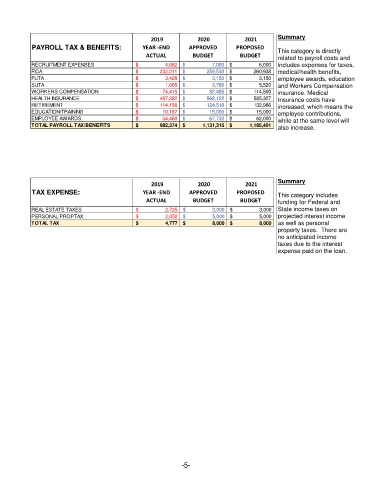

Summary

2019 2020 2021

PAYROLL TAX & BENEFITS: YEAR -END APPROVED PROPOSED This category is directly

ACTUAL BUDGET BUDGET related to payroll costs and

RECRUITMENT EXPENSES $ 4,662 $ 7,000 $ 6,000 includes expenses for taxes,

FICA $ 232,011 $ 259,530 $ 260,938 medical/health benefits,

FUTA $ 3,428 $ 3,150 $ 3,150 employee awards, education

SUTA $ 1,665 $ 3,780 $ 5,520 and Workers Compensation

WORKERS COMPENSATION $ 74,415 $ 82,485 $ 114,500 insurance. Medical

HEALTH INSURANCE $ 487,382 $ 568,122 $ 585,327 Insurance costs have

RETIREMENT $ 114,156 $ 124,516 $ 132,966 increased, which means the

EDUCATION/TRAINING $ 10,187 $ 15,000 $ 15,000 employee contributions,

EMPLOYEE AWARDS $ 54,468 $ 67,732 $ 62,000 while at the same level will

TOTAL PAYROLL TAX/BENEFITS $ 982,374 $ 1,131,315 $ 1,185,401 also increase.

Summary

2019 2020 2021

TAX EXPENSE: YEAR -END APPROVED PROPOSED This category includes

ACTUAL BUDGET BUDGET funding for Federal and

REAL ESTATE TAXES $ 2,725 $ 3,000 $ 3,000 State income taxes on

PERSONAL PROPTAX $ 2,052 $ 5,000 $ 5,000 projected interest income

TOTAL TAX $ 4,777 $ 8,000 $ 8,000 as well as personal

property taxes. There are

no anticipated income

taxes due to the interest

expense paid on the loan.

-5-