Page 41 - 2022 - annual report

P. 41

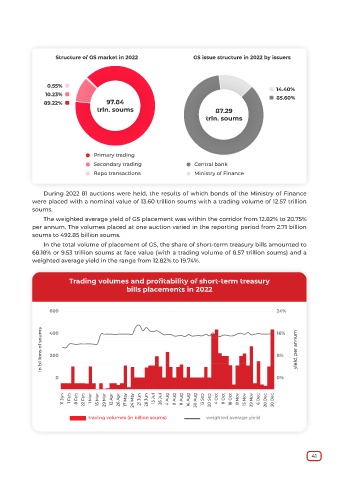

Structure of GS market in 2022 GS issue structure in 2022 by issuers

0.55% ⏹

⏹ 14.40%

10.23% ⏹ ⏹ 85.60%

89.22% ⏹ 97.84

trln. soums 87.29

trln. soums

⚪ Primary trading

⚪ Secondary trading ⚪ Central bank

⚪ Repo transactions ⚪ Ministry of Finance

During 2022 81 auctions were held, the results of which bonds of the Ministry of Finance

were placed with a nominal value of 13.60 trillion soums with a trading volume of 12.57 trillion

soums.

The weighted average yield of GS placement was within the corridor from 12.82% to 20.75%

per annum. The volumes placed at one auction varied in the reporting period from 2.71 billion

soums to 492.85 billion soums.

In the total volume of placement of GS, the share of short-term treasury bills amounted to

68.18% or 9.53 trillion soums at face value (with a trading volume of 8.57 trillion soums) and a

weighted average yield in the range from 12.82% to 19.74%.

Trading volumes and profitability of short-term treasury

bills placements in 2022

600 24%

in billions of soums 400 16% yield, per annum

8%

200

0 0%

11 Jan 1 Feb 8 Feb 22 Feb 1 Mar 15 Mar 29 Mar 12 Apr 26 Apr 17 May 24 May 21 Jun 28 Jun 13 Jul 26 Jul 4 Aug 9 Aug 11 Aug 16 Aug 30 Aug 13 Sep 20 Sep 4 Oct 11 Oct 18 Oct 8 Nov 15 Nov 29 Nov 6 Dec 20 Dec 30 Dec

trading volumes (in billion soums) weighted average yield

41