Page 42 - 2022 - annual report

P. 42

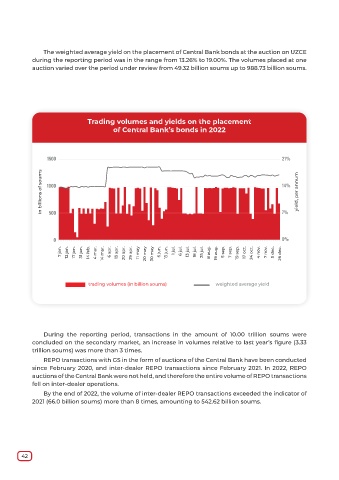

The weighted average yield on the placement of Central Bank bonds at the auction on UZCE

during the reporting period was in the range from 13.26% to 19.00%. The volumes placed at one

auction varied over the period under review from 49.32 billion soums up to 988.73 billion soums.

Trading volumes and yields on the placement

of Central Bank’s bonds in 2022

1500 21%

in billions of soums 1000 14% yield, per annum

7%

500

0 0%

7 jan. 12 jan. 17 jan. 31 jan. 14 feb. 4 mar. 14 mar. 6 apr. 13 apr. 20 apr. 29 apr. 11 may 20 may 30 may 6 jun. 13 jun. 1 jul. 6 jul. 13 jul. 18 jul. 25 jul. 8 aug. 19 aug. 5 sep. 7 sep. 19 sep. 17 oct. 24 oct. 4 nov. 7 nov. 5 dec. 26 dec.

trading volumes (in billion soums) weighted average yield

During the reporting period, transactions in the amount of 10.00 trillion soums were

concluded on the secondary market, an increase in volumes relative to last year’s figure (3.33

trillion soums) was more than 3 times.

REPO transactions with GS in the form of auctions of the Central Bank have been conducted

since February 2020, and inter-dealer REPO transactions since February 2021. In 2022, REPO

auctions of the Central Bank were not held, and therefore the entire volume of REPO transactions

fell on inter-dealer operations.

By the end of 2022, the volume of inter-dealer REPO transactions exceeded the indicator of

2021 (66.0 billion soums) more than 8 times, amounting to 542.62 billion soums.

42