Page 30 - Microsoft Word - Hot Shots CIM Version 1.9.2 Final

P. 30

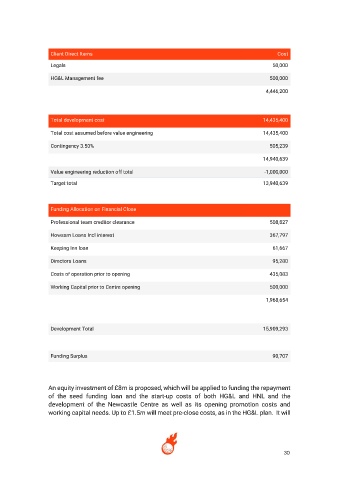

Client Direct Items Cost

Legals 50,000

HG&L Management fee 500,000

4,446,200

Total development cost 14,435,400

Total cost assumed before value engineering 14,435,400

Contingency 3.50% 505,239

14,940,639

Value engineering reduction off total -1,000,000

Target total 13,940,639

Funding Allocation on Financial Close

Professional team creditor clearance 508,827

Howsam Loans Incl interest 367,797

Keeping Inn loan 61,667

Directors Loans 95,280

Costs of operation prior to opening 435,083

Working Capital prior to Centre opening 500,000

1,968,654

Development Total 15,909,293

Funding Surplus 90,707

An equity investment of £8m is proposed, which will be applied to funding the repayment

of the seed funding loan and the start-up costs of both HG&L and HNL and the

development of the Newcastle Centre as well as its opening promotion costs and

working capital needs. Up to £1.5m will meet pre-close costs, as in the HG&L plan. It will

30