Page 19 - MEOG Annual Review 2021

P. 19

MEOG AUGUST MEOG

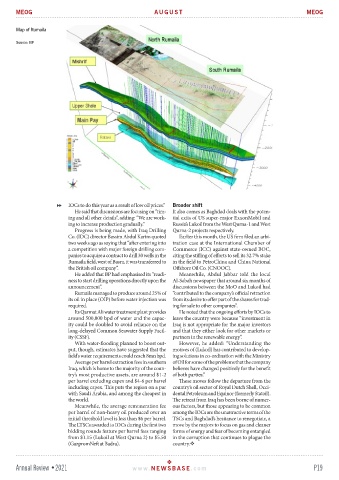

Map of Rumaila

Source: BP

IOCs to do this year as a result of low oil prices.” Broader shift

He said that discussions are focusing on “tim- It also comes as Baghdad deals with the poten-

ing and all other details”, adding: “We are work- tial exits of US super-major ExxonMobil and

ing to increase production gradually.” Russia’s Lukoil from the West Qurna-1 and West

Progress is being made, with Iraq Drilling Qurna-2 projects respectively.

Co. (IDC) director Bassim Abdul Karim quoted Earlier this month, the US firm filed an arbi-

two weeks ago as saying that “after entering into tration case at the International Chamber of

a competition with major foreign drilling com- Commerce (ICC) against state-owned BOC,

panies to acquire a contract to drill 30 wells in the citing the stifling of efforts to sell its 32.7% stake

Rumaila field, west of Basra, it was transferred to in the field to PetroChina and China National

the British oil company”. Offshore Oil Co. (CNOOC).

He added that BP had emphasised its “readi- Meanwhile, Abdul Jabbar told the local

ness to start drilling operations directly upon the Al-Sabah newspaper that around six months of

announcement”. discussions between the MoO and Lukoil had

Rumaila managed to produce around 25% of “contributed to the company’s official retraction

its oil in place (OIP) before water injection was from its desire to offer part of the shares for trad-

required. ing for sale to other companies”.

Its Qarmat Ali water treatment plant provides He noted that the ongoing efforts by IOCs to

around 500,000 bpd of water and the capac- leave the country were because “investment in

ity could be doubled to avoid reliance on the Iraq is not appropriate for the major investors

long-delayed Common Seawater Supply Facil- and that they either look for other markets or

ity (CSSF). partners in the renewable energy”.

With water-flooding planned to boost out- However, he added: “Understanding the

put, though, estimates have suggested that the motives of (Lukoil) has contributed to develop-

field’s water requirements could reach 8mn bpd. ing solutions in co-ordination with the Ministry

Average per barrel extraction fees in southern of Oil for some of the problems that the company

Iraq, which is home to the majority of the coun- believes have changed positively for the benefit

try’s most productive assets, are around $1-2 of both parties.”

per barrel excluding capex and $4-6 per barrel These moves follow the departure from the

including capex. This puts the region on a par country’s oil sector of Royal Dutch Shell, Occi-

with Saudi Arabia, and among the cheapest in dental Petroleum and Equinor (formerly Statoil).

the world. The retreat from Iraq has been borne of numer-

Meanwhile, the average remuneration fee ous factors, but those appearing to be common

per barrel of non-heavy oil produced over an among the IOCs are the unattractive terms of the

initial threshold level is less than $6 per barrel. TSCs and Baghdad’s hesitance to renegotiate, a

The LTSCs awarded to IOCs during the first two move by the majors to focus on gas and cleaner

bidding rounds feature per barrel fees ranging forms of energy and fear of becoming entangled

from $1.15 (Lukoil at West Qurna 2) to $5.50 in the corruption that continues to plague the

(GazpromNeft at Badra). country.

Annual Review •2021 www. NEWSBASE .com P19