Page 21 - MEOG Annual Review 2021

P. 21

MEOG SEPTEMBER MEOG

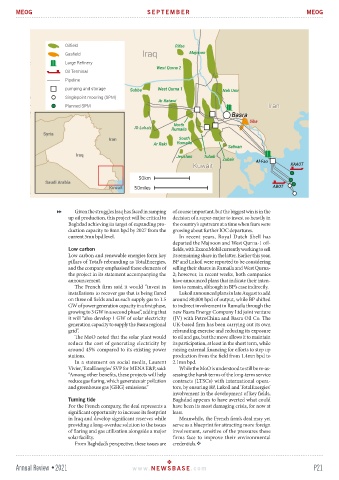

Given the struggles Iraq has faced in ramping of course important, but the biggest win is in the

up oil production, this project will be critical to decision of a super-major to invest so heavily in

Baghdad achieving its target of expanding pro- the country’s upstream at a time when fears were

duction capacity to 8mn bpd by 2027 from the growing about further IOC departures.

current 5mn bpd level. In recent years, Royal Dutch Shell has

departed the Majnoon and West Qurna-1 oil-

Low carbon fields, with ExxonMobil currently working to sell

Low carbon and renewable energies form key its remaining share in the latter. Earlier this year,

pillars of Total’s rebranding as TotalEnergies, BP and Lukoil were reported to be considering

and the company emphasised these elements of selling their shares in Rumaila and West Qurna-

the project in its statement accompanying the 2; however, in recent weeks, both companies

announcement. have announced plans that indicate their inten-

The French firm said it would “invest in tion to remain, although in BP’s case indirectly.

installations to recover gas that is being flared Lukoil announced plans in late August to add

on three oil fields and as such supply gas to 1.5 around 80,000 bpd of output, while BP shifted

GW of power generation capacity in a first phase, to indirect involvement in Rumaila through the

growing to 3 GW in a second phase”, adding that new Basra Energy Company Ltd joint venture

it will “also develop 1 GW of solar electricity (JV) with PetroChina and Basra Oil Co. The

generation capacity to supply the Basra regional UK-based firm has been carrying out its own

grid”. rebranding exercise and reducing its exposure

The MoO noted that the solar plant would to oil and gas, but the move allows it to maintain

reduce the cost of generating electricity by its participation, at least in the short term, while

around 45% compared to its existing power raising external financing for efforts to step up

stations. production from the field from 1.4mn bpd to

In a statement on social media, Laurent 2.1mn bpd.

Vivier, TotalEnergies’ SVP for MENA E&P, said: While the MoO is understood to still be re-as-

“Among other benefits, these projects will help sessing the harsh terms of the long-term service

reduce gas flaring, which generates air pollution contracts (LTSCs) with international opera-

and greenhouse gas [GHG] emissions.” tors, by ensuring BP, Lukoil and TotalEnergies’

involvement in the development of key fields,

Turning tide Baghdad appears to have averted what could

For the French company, the deal represents a have been its most damaging crisis, for now at

significant opportunity to increase its footprint least.

in Iraq and develop significant reserves while Meanwhile, the French firm’s deal may yet

providing a long-overdue solution to the issues serve as a blueprint for attracting more foreign

of flaring and gas utilisation alongside a major involvement, sensitive of the pressures these

solar facility. firms face to improve their environmental

From Baghdad’s perspective, these issues are credentials.

Annual Review •2021 www. NEWSBASE .com P21