Page 22 - MEOG Annual Review 2021

P. 22

MEOG OCTOBER MEOG

Northern Syria back in focus

It is a little more than a year since a controversial agreement was signed for

US involvement in the Syrian oil sector, and little appears to have changed.

SYRIA WASHINGTON’S lack of a consistent foreign Reserves

policy stance on Syria has attracted widespread Syria has proven reserves of 2.5bn barrels of oil

scrutiny as well as fears among locals of betrayal. and 241bn cubic metres of gas, oil production is

WHAT: This was not helped by former President Don- estimated at 15,000-40,000 bpd, though capacity

Delta Crescent Energy’s ald Trump’s proclamation last year that the US was running at around 400,000 barrels per day

contentious sanctions should “keep the oil” for bringing stability to (bpd) before civil war broke out in 2011. Num-

waiver expired in April, Syria. bers for gas are less clear, but the most recent ver-

though the company is Little over a year on, Trump has left office, the ified data, from 2011, showed output of 8.95mn

said to be keen to remain licence awarded to Delta Crescent Energy (DCE) cubic metres per day of dry natural gas, and

in Syria. the corporate proxy sent to “modernise” oilfields more recent estimates are just 3.4 mcm per day.

in north-eastern Syria has expired and “stability” In late 2019 a US defence official was quoted

WHY: appears no closer. by Kurdish media as saying that the US had

The US was heavily The administration of Joe Biden seems to commenced “reinforcing positions in the Deir

criticised for the deal “have opted for a careful balance of ambiguity ez-Zor region, in co-ordination with [SDF] part-

which was slated on both and a leisurely pace of change that started by ners, with additional military assets to prevent

political and commercial granting a higher degree of freedom of deci- the oilfields from falling back into the hands of

levels. sion-making for some of its Arab partners ISIS or other destabilising actors.”

which have been for years expressing eagerness The SDF brought the country’s Tanak oilfield

WHAT NEXT: to expand their currently limited co-operation back on stream in August 2018, roughly a year

Russian involvement is with Damascus,” according to Syria specialist after it and the US-backed YPG took the control

set to grow as reports Camille Otrakji. of the asset from Daesh militants.

emerge about companies In May, a US official was quoted by the AP as Tanak, Syria’s second-largest oilfield, is

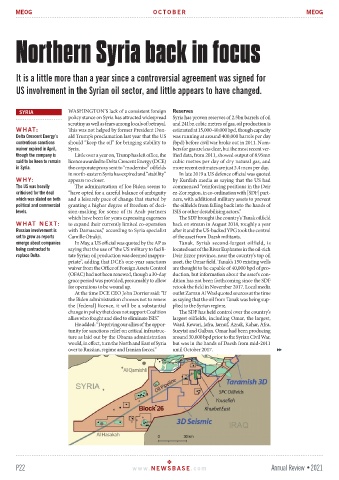

being contracted to saying that the use of “the US military to facili- located east of the River Euphrates in the oil-rich

replace Delta. tate Syrian oil production was deemed inappro- Deir Ezzor province, near the country’s top oil

priate”, adding that DCE’s one-year sanctions asset, the Omar field. Tanak’s 150 existing wells

waiver from the Office of Foreign Assets Control are thought to be capable of 40,000 bpd of pro-

(OFAC) had not been renewed, though a 30-day duction, but information about the asset’s con-

grace period was provided, presumably to allow dition has not been forthcoming since the SDF

for operations to be wound up. retook the field in November 2017. Local media

At the time DCE CEO John Dorrier said: “If outlet Zaman Al Wasl quoted sources at the time

the Biden administration chooses not to renew as saying that the oil from Tanak was being sup-

the [federal] licence, it will be a substantial plied to the Syrian regime.

change in policy that does not support Coalition The SDF has held control over the country’s

allies who fought and died to eliminate ISIS.” largest oilfields, including Omar, the largest,

He added: “Depriving our allies of the oppor- Ward, Kewari, Jafra, Jarnuf, Azrak, Kahar, Afra,

tunity for sanctions relief on critical infrastruc- Sueytat and Galban. Omar had been producing

ture as laid out by the Obama administration around 30,000 bpd prior to the Syrian Civil War,

would, in effect, turn the North and East of Syria but was in the hands of Daesh from mid-2011

over to Russian, regime and Iranian forces.” until October 2017.

P22 www. NEWSBASE .com Annual Review •2021