Page 44 - SE Outlook Regions 2022

P. 44

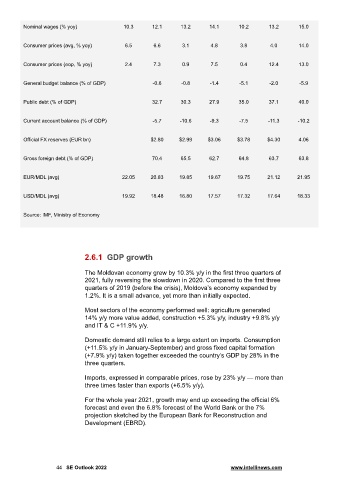

Nominal wages (% yoy) 10.3 12.1 13.2 14.1 10.2 13.2 15.0

Consumer prices (avg, % yoy) 6.5 6.6 3.1 4.8 3.8 4.0 14.0

Consumer prices (eop, % yoy) 2.4 7.3 0.9 7.5 0.4 12.4 13.0

General budget balance (% of GDP) -0.6 -0.8 -1.4 -5.1 -2.0 -5.9

Public debt (% of GDP) 32.7 30.3 27.9 35.0 37.1 40.0

Current account balance (% of GDP) -5.7 -10.6 -9.3 -7.5 -11.3 -10.2

Official FX reserves (EUR bn) $2.80 $2.99 $3.06 $3.78 $4.30 4.06

Gross foreign debt (% of GDP) 70.4 65.5 62.7 64.8 63.7 63.8

EUR/MDL (avg) 22.05 20.83 19.85 19.67 19.75 21.12 21.95

USD/MDL (avg) 19.92 18.48 16.80 17.57 17.32 17.64 18.33

Source: IMF, Ministry of Economy

2.6.1 GDP growth

The Moldovan economy grew by 10.3% y/y in the first three quarters of

2021, fully reversing the slowdown in 2020. Compared to the first three

quarters of 2019 (before the crisis), Moldova’s economy expanded by

1.2%. It is a small advance, yet more than initially expected.

Most sectors of the economy performed well: agriculture generated

14% y/y more value added, construction +5.3% y/y, industry +9.8% y/y

and IT & C +11.9% y/y.

Domestic demand still relies to a large extent on imports. Consumption

(+11.5% y/y in January-September) and gross fixed capital formation

(+7.9% y/y) taken together exceeded the country’s GDP by 28% in the

three quarters.

Imports, expressed in comparable prices, rose by 23% y/y — more than

three times faster than exports (+6.5% y/y).

For the whole year 2021, growth may end up exceeding the official 6%

forecast and even the 6.8% forecast of the World Bank or the 7%

projection sketched by the European Bank for Reconstruction and

Development (EBRD).

44 SE Outlook 2022 www.intellinews.com