Page 46 - SE Outlook Regions 2022

P. 46

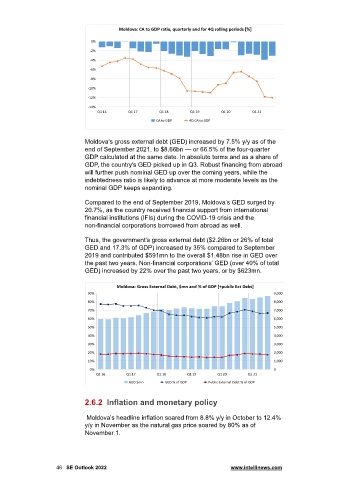

Moldova’s gross external debt (GED) increased by 7.5% y/y as of the

end of September 2021, to $8.66bn — or 66.5% of the four-quarter

GDP calculated at the same date. In absolute terms and as a share of

GDP, the country's GED picked up in Q3. Robust financing from abroad

will further push nominal GED up over the coming years, while the

indebtedness ratio is likely to advance at more moderate levels as the

nominal GDP keeps expanding.

Compared to the end of September 2019, Moldova’s GED surged by

20.7%, as the country received financial support from international

financial institutions (IFIs) during the COVID-19 crisis and the

non-financial corporations borrowed from abroad as well.

Thus, the government’s gross external debt ($2.26bn or 26% of total

GED and 17.3% of GDP) increased by 35% compared to September

2019 and contributed $591mn to the overall $1.48bn rise in GED over

the past two years. Non-financial corporations’ GED (over 40% of total

GED) increased by 22% over the past two years, or by $623mn.

2.6.2 Inflation and monetary policy

Moldova’s headline inflation soared from 8.8% y/y in October to 12.4%

y/y in November as the natural gas price soared by 80% as of

November 1.

46 SE Outlook 2022 www.intellinews.com