Page 11 - MEOG Week 49 2021

P. 11

MEOG PROJECTS & COMPANIES MEOG

Halliburton denies West Qurna-1 reports

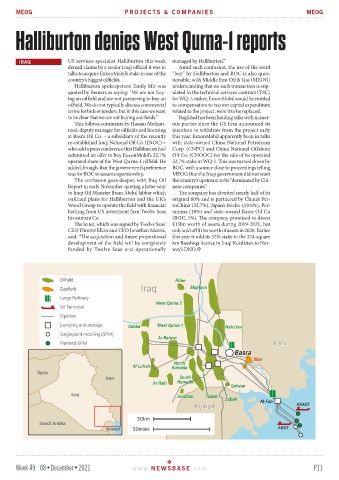

IRAQ US services specialist Halliburton this week managed by Halliburton.”

denied claims by a senior Iraqi official it was in Amid such confusion, the use of the word

talks to acquire ExxonMobil’s stake in one of the “buy” by Halliburton and BOC is also ques-

country’s biggest oilfields. tionable, with Middle East Oil & Gas (MEOG)

Halliburton spokesperson Emily Mir was understanding that no such transaction is stip-

quoted by Reuters as saying: “We are not buy- ulated in the technical services contract (TSC)

ing an oilfield and are not partnering to buy an for WQ-1; rather, ExxonMobil would be entitled

oilfield. We do not typically discuss commercial to compensation to recover capital expenditure

terms for bids or tenders, but in this case we want related to the project, were it to be replaced.

to be clear that we are not buying any fields.” Baghdad has been holding talks with numer-

This follows comments by Hassan Moham- ous parties since the US firm announced its

med, deputy manager for oilfields and licensing intention to withdraw from the project early

at Basra Oil Co. – a subsidiary of the recently this year. ExxonMobil apparently been in talks

re-established Iraqi National Oil Co. (INOC) – with state-owned China National Petroleum

who told a press conference that Halliburton had Corp. (CNPC) and China National Offshore

submitted an offer to buy ExxonMobil’s 32.7% Oil Co. (CNOOC) for the sale of its operated

operated share of the West Qurna-1 oilfield. He 32.7% stake in WQ-1. This was turned down by

added, though, that the government’s preference BOC, with a source close to proceedings telling

was for BOC to assume operatorship. MEOG that the Iraqi government did not want

The confusion goes deeper, with Iraq Oil the country’s upstream to be “dominated by Chi-

Report in early November quoting a letter sent nese companies”.

to Iraqi Oil Minister Ihsan Abdul Jabbar which The company has divested nearly half of its

outlined plans for Halliburton and the UK’s original 60% and is partnered by China’s Pet-

Wood Group to operate the field with financial roChina (32.7%), Japan’s Itochu (19.6%), Per-

backing from US investment firm Twelve Seas tamina (10%) and state-owned Basra Oil Co

Investment Co. (BOC, 5%). The company promised to divest

The letter, which was signed by Twelve Seas’ $15bn worth of assets during 2019-2021, but

CEO Dimitri Elkin and CFO Jonathan Morris, only sold off $1bn worth of assets in 2020. Earlier

said: “The acquisition and future proportional this year it sold its 32% stake in the 324-square

development of the field will be completely km Baeshiqa licence in Iraqi Kurdistan to Nor-

funded by Twelve Seas and operationally way’s DNO.

Week 49 08•December•2021 www. NEWSBASE .com P11