Page 9 - DMEA Week 19 2022

P. 9

DMEA COMPANIES DMEA

Aramco agrees downstream

deal with Thailand’s PTT

MIDDLE EAST STATE-BACKED Saudi Aramco this week supply planning, Ibrahim Al-Buainain, said

agreed a memorandum of understanding that the arrangement “represents an important

(MoU) with Thai counterpart PTT to explore step forward as we deepen and broaden this

potential collaboration in the downstream sec- relationship to achieve greater co-operation.”

tor. The move comes as part of Aramco’s long- Meanwhile, PTT’s president and CEO Autta-

term strategy of expansion in Asia with a view pol Rerkpiboon highlighted the supply secu-

to guaranteeing outlets for its domestically rity benefits of deeper ties with Aramco, while

produced crude oil. alluding to the extension of the relationship

During a meeting in Bangkok, the com- “beyond conventional energy”.

panies agreed to work towards deeper co-op- The move follows Aramco’s final investment

eration in the sourcing of crude oil and the decision (FID) in March on the development of

marketing of refining and petrochemical prod- an integrated refinery and petrochemical com-

ucts and LNG, with an Aramco press release plex in north-eastern China in collaboration

noting blue and green hydrogen and clean with local partners.

energy initiatives as other potential areas of The Huajin Aramco Petrochemical Co.

focus. (HAPCO) was formed in late 2019 between

The Saudi firm has no liquefaction capacity the Saudi firm and China’s North Huajin

and comments over the past year or two sug- Chemical Industries Group Corp. and local

gest that it is more likely to direct investment government-owned Panjin Xincheng Indus-

towards hydrogen and carrier fuels like ammo- trial Group. Aramco said that the JV will build

nia, with a view to extending its position as the a $10bn, 300,000 barrel per day (bpd) refinery

world’s “pre-eminence in oil and gas” into the capacity and ethylene-based steam cracker

nascent hydrogen sector. which is expected to be commissioned in 2024.

It does, however, appear to be an oppor- In line with the company’s strategy of

tunity for Aramco’s downstream and trading increasing the number of outlets dedicated

teams to leverage stronger ties with another to its crude production, Aramco intends to

Asian customer to shelter Saudi crude from supply 70% (210,000 bpd) of the facility’s feed-

long-term market volatility while continuing stock, taking a 35% stake in the project, with

to diversify revenue streams. Norinco subsidiary Huajin holding 36% and

Aramco’s vice president of sales, trading and Xincheng the remaining 29%.

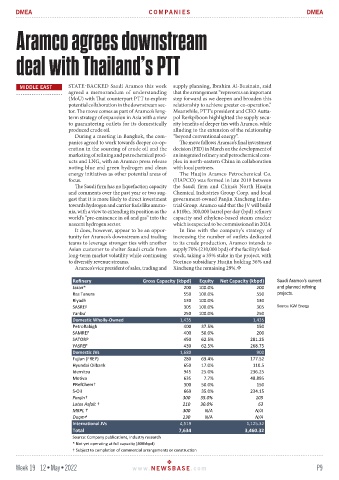

Refinery Gross Capacity (kbpd) Equity Net Capacity (kbpd) Saudi Aramco’s current

Jazan* 200 100.0% 200 and planned refining

Ras Tanura 550 100.0% 550 projects.

Riyadh 130 100.0% 130

SASREF 305 100.0% 305 Source: IGM Energy

Yanbu' 250 100.0% 250

Domestic Wholly-Owned 1,435 1,435

PetroRabigh 400 37.5% 150

SAMREF 400 50.0% 200

SATORP 450 62.5% 281.25

YASREF 430 62.5% 268.75

Domestic JVs 1,680 900

Fujian (FREP) 280 63.4% 177.52

Hyundai Oilbank 650 17.0% 110.5

Idemitsu 945 25.0% 236.25

Motiva 635 7.7% 48.895

PRefChem† 300 50.0% 150

S-Oil 669 35.0% 234.15

Panjin† 300 35.0% 105

Lotos Asfalt † 210 30.0% 63

MRPL † 300 N/A N/A

Duqm† 230 N/A N/A

International JVs 4,519 1,125.32

Total 7,634 3,460.32

Source: Company publications, industry research

* Not yet operating at full capacity (400kbpd)

† Subject to comple�on of commercial arrangements or construc�on

Week 19 12•May•2022 www. NEWSBASE .com P9