Page 13 - LatAmOil Week 26 2021

P. 13

LatAmOil ARGENTINA LatAmOil

Additionally, it will raise the share of oil in total testimony to the fact.”

yields from 15% to 37%. CGC was established as an independent

Hugo Ernekian, the president and CEO of company but has been a member of the Argen-

CGC, expressed satisfaction with the deal, say- tinian economic group known as Corporación

ing that it “reaffirms CGC’s vision of continued América International (CAI) since 2013. Over

growth and investment in Argentina.” the last eight years, it has spent more than $1.5bn

He added: “We are sure of the immense on conventional and unconventional oil and gas

and diverse potential offered by our country’s projects in Argentina. These investments have

geology, not only in shale but especially in tight raised the company’s production nearly sev-

and conventional gas. This step we are taking is en-fold on the 2013 figure of 8,300 boepd.

Neuquén Province approves Vista’s

plan to sell stake in CASO to Shell

VISTA Oil & Gas, a Latin America-focused block, said the sources, who spoke on condition

company with headquarters in Mexico City, of anonymity.

has secured approval for plans to sell its 10% Vista joined the CASO project in 2018. The

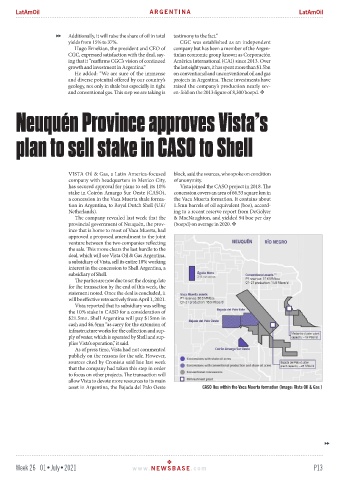

stake in Coirón Amargo Sur Oeste (CASO), concession covers an area of 66.53 square km in

a concession in the Vaca Muerta shale forma- the Vaca Muerta formation. It contains about

tion in Argentina, to Royal Dutch Shell (UK/ 1.5mn barrels of oil equivalent (boe), accord-

Netherlands). ing to a recent reserve report from DeGolyer

The company revealed last week that the & MacNaughton, and yielded 94 boe per day

provincial government of Neuquén, the prov- (boepd) on average in 2020.

ince that is home to most of Vaca Muerta, had

approved a proposed amendment to the joint

venture between the two companies reflecting

the sale. This move clears the last hurdle to the

deal, which will see Vista Oil & Gas Argentina,

a subsidiary of Vista, sell its entire 10% working

interest in the concession to Shell Argentina, a

subsidiary of Shell.

The parties are now due to set the closing date

for the transaction by the end of this week, the

statement noted. Once the deal is concluded, it

will be effective retroactively from April 1, 2021.

Vista reported that its subsidiary was selling

the 10% stake in CASO for a consideration of

$21.5mn. Shell Argentina will pay $15mn in

cash and $6.5mn “as carry for the extension of

infrastructure works for the collection and sup-

ply of water, which is operated by Shell and sup-

plies Vista’s operation,” it said.

As of press time, Vista had not commented

publicly on the reasons for the sale. However,

sources cited by Cronista said late last week

that the company had taken this step in order

to focus on other projects. The transaction will

allow Vista to devote more resources to its main

asset in Argentina, the Bajada del Palo Oeste CASO lies within the Vaca Muerta formation (Image: Vista Oil & Gas )

Week 26 01•July•2021 www. NEWSBASE .com P13