Page 5 - DMEA Week 50 2021

P. 5

DMEA COMMENTARY DMEA

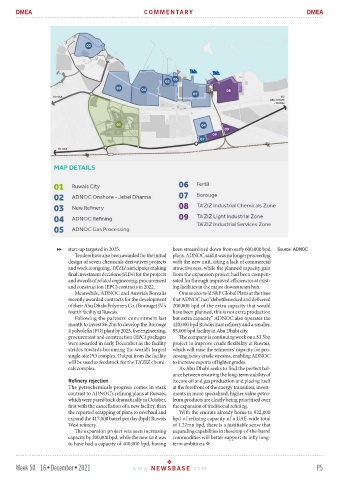

start-up targeted in 2025. been streamlined down from early 600,000 bpd Source: ADNOC

Tenders have also been awarded for the initial plans. ADNOC said it was no longer proceeding

design of seven chemicals derivatives projects with the new unit, citing a lack of commercial

and work is ongoing. TA’ZIZ anticipates making attractiveness, while the planned capacity gain

final investment decisions (FIDs) for the projects from the expansion project had been compen-

and awards of related engineering, procurement sated for through improved efficiencies at exist-

and construction (EPC) contracts in 2022. ing facilities in the major downstream hub.

Meanwhile, ADNOC and Austria’s Borealis One source told S&P Global Platts at the time

recently awarded contracts for the development that ADNOC had “debottlenecked and delivered

of their Abu Dhabi Polymers Co. (Borouge) JV’s 200,000 bpd of the extra capacity that would

fourth facility at Ruwais. have been planned, this is not extra production

Following the partners’ commitment last but extra capacity.” ADNOC also operates the

month to invest $6.2bn to develop the Borouge 420,000 bpd Ruwais East refinery and a smaller,

4 polyolefin (PO) plant by 2025, five engineering, 85,000 bpd facility in Abu Dhabi city.

procurement and construction (EPC) packages The company is continuing work on a $3.5bn

were awarded in early December as the facility project to improve crude flexibility at Ruwais,

strides towards becoming the world’s largest which will raise the refineries’ capacity for pro-

single-site PO complex. Output from the facility cessing heavy crude streams, enabling ADNOC

will be used as feedstock for the TA’ZIZ chemi- to increase exports of lighter grades.

cals complex. As Abu Dhabi seeks to find the perfect bal-

ance between ensuring the long-term stability of

Refinery rejection its core oil and gas production and placing itself

The petrochemicals progress comes in stark at the forefront of the energy transition, invest-

contrast to ADNOC’s refining plans at Ruwais, ments in more specialised, higher value petro-

which were pared back dramatically in October, leum products are clearly being prioritised over

first with the cancellation of a new facility, then the expansion of traditional refining.

the reported scrapping of plans to overhaul and With the emirate already home to 922,000

expand the 417,000 barrel per day (bpd) Ruwais bpd of refining capacity of a UAE-wide total

West refinery. of 1.27mn bpd, there is a justifiable sense that

The expansion project was seen increasing expanding capabilities in these top-of-the-barrel

capacity by 200,000 bpd, while the new unit was commodities will better support its lofty long-

to have had a capacity of 400,000 bpd, having term ambitions.

Week 50 16•December•2021 www. NEWSBASE .com P5