Page 136 - NobleCon21

P. 136

Financials

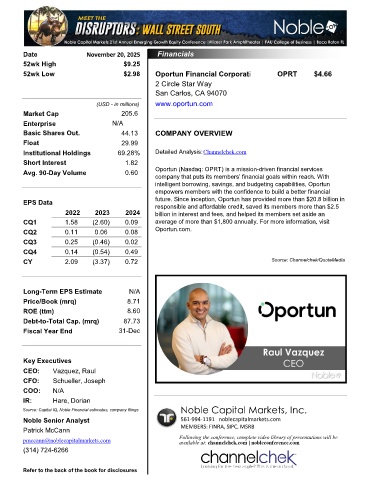

Date November 20, 2025 Financials

52wk High $9.25

52wk Low $2.98 Oportun Financial Corporati OPRT $4.66

2 Circle Star Way

San Carlos, CA 94070

(USD - in millions) www.oportun.com

Market Cap 205.6

Enterprise N/A

Basic Shares Out. 44.13 COMPANY OVERVIEW

Float 29.99

Institutional Holdings 69.28% Detailed Analysis:Channelchek.com

Short Interest 1.82

Avg. 90-Day Volume 0.60 Oportun (Nasdaq: OPRT) is a mission-driven financial services

company that puts its members’ financial goals within reach. With

intelligent borrowing, savings, and budgeting capabilities, Oportun

empowers members with the confidence to build a better financial

EPS Data future. Since inception, Oportun has provided more than $20.8 billion in

responsible and affordable credit, saved its members more than $2.5

2022 2023 2024 billion in interest and fees, and helped its members set aside an

CQ1 1.58 (2.60) 0.09 average of more than $1,800 annually. For more information, visit

CQ2 0.11 0.06 0.08 Oportun.com.

CQ3 0.25 (0.46) 0.02

CQ4 0.14 (0.54) 0.49

CY 2.09 (3.37) 0.72 Source: Channelchek/QuoteMedia

Long-Term EPS Estimate N/A

Price/Book (mrq) 8.71

ROE (ttm) 8.60

Debt-to-Total Cap. (mrq) 87.73

Fiscal Year End 31-Dec

2 Circle Star WSan Carlos CA 94070

Key Executives

CEO: Vazquez, Raul

CFO: Schueller, Joseph

COO: N/A

IR: Hare, Dorian

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Patrick McCann MEMBERS: FINRA, SIPC, MSRB

pmccann@noblecapitalmarkets.com Following the conference, complete video library of presentations will be

available at: channelchek.com | nobleconference.com

(314) 724-6266

Refer to the back of the book for disclosures