Page 178 - NobleCon21

P. 178

Industrials

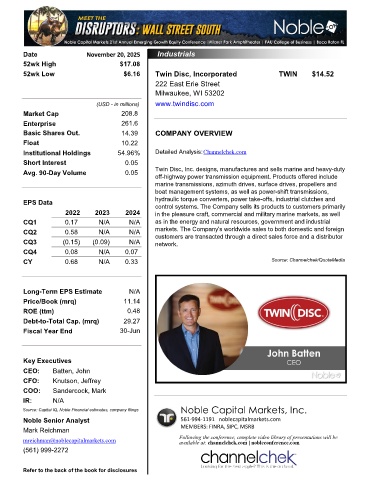

Date November 20, 2025 Industrials

52wk High $17.08

52wk Low $6.16 Twin Disc, Incorporated TWIN $14.52

222 East Erie Street

Milwaukee, WI 53202

(USD - in millions) www.twindisc.com

Market Cap 208.8

Enterprise 261.6

Basic Shares Out. 14.39 COMPANY OVERVIEW

Float 10.22

Institutional Holdings 54.96% Detailed Analysis:Channelchek.com

Short Interest 0.05

Avg. 90-Day Volume 0.05 Twin Disc, Inc. designs, manufactures and sells marine and heavy-duty

off-highway power transmission equipment. Products offered include

marine transmissions, azimuth drives, surface drives, propellers and

boat management systems, as well as power-shift transmissions,

EPS Data hydraulic torque converters, power take-offs, industrial clutches and

control systems. The Company sells its products to customers primarily

2022 2023 2024 in the pleasure craft, commercial and military marine markets, as well

CQ1 0.17 N/A N/A as in the energy and natural resources, government and industrial

CQ2 0.58 N/A N/A markets. The Company’s worldwide sales to both domestic and foreign

customers are transacted through a direct sales force and a distributor

CQ3 (0.15) (0.09) N/A network.

CQ4 0.08 N/A 0.07

CY 0.68 N/A 0.33 Source: Channelchek/QuoteMedia

Long-Term EPS Estimate N/A

Price/Book (mrq) 11.14

ROE (ttm) 0.48

Debt-to-Total Cap. (mrq) 29.27

Fiscal Year End 30-Jun

222 East Erie Milwaukee WI 53202

Key Executives

CEO: Batten, John

CFO: Knutson, Jeffrey

COO: Sandercock, Mark

IR: N/A

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Mark Reichman MEMBERS: FINRA, SIPC, MSRB

mreichman@noblecapitalmarkets.com Following the conference, complete video library of presentations will be

available at: channelchek.com | nobleconference.com

(561) 999-2272

Refer to the back of the book for disclosures